Sesen Bio and Carisma Therapeutics Announce Merger Agreement

- Transaction to create a well-funded, clinical-stage biotechnology company advancing engineered macrophages for the treatment of cancer and other serious disorders

- Combined company expected to have approximately $180 million of cash, cash equivalents and marketable securities at close, including $30 million from a concurrent financing by Carisma, which is expected to fund the combined company through 2024

- Cash runway of combined company expected to enable multiple clinical readouts across Carisma programs

CAMBRIDGE, Mass. and PHILADELPHIA, Penn., Sep. 21, 2022 – Sesen Bio, Inc. (Nasdaq: SESN) and Carisma Therapeutics Inc. (Carisma), a privately held, clinical stage biopharmaceutical company focused on discovering and developing innovative immunotherapies, announced today that they have entered into a definitive merger agreement to combine the companies in an all-stock transaction. The combined company will focus on the advancement of Carisma’s proprietary cell therapy platform that utilizes engineered macrophages and monocytes to potentially transform the treatment of cancer and other serious disorders. Carisma is pioneering the development of chimeric antigen receptor macrophage (CAR-M) therapies and is believed to be the only company developing CAR-M therapies with demonstrated proof of mechanism and safety data in clinical trials. The combined company is expected to operate under the name Carisma Therapeutics Inc. and trade on Nasdaq under the ticker symbol “CARM”.

Carisma has also secured commitments from a syndicate of investors for a $30 million financing, including HealthCap, AbbVie, Wellington Partners, SymBiosis, Penn Medicine, TPG Biotech, MRL Ventures Fund, the therapeutics-focused corporate venture arm of Merck & Co., Agent Capital, Solasta, Livzon, Pictet Alternative Advisors and 4Bio, which is expected to close concurrently with the completion of the merger. With the cash expected from both companies at closing and the proceeds of the concurrent financing, the combined company is expected to have approximately $180 million in cash, cash equivalents and marketable securities. These cash resources are expected to be used to advance Carisma’s pipeline through multiple ongoing and planned key data readouts across several clinical trials and to fund operating expenses and capital expenditure requirements through 2024. The merger and related financing are expected to close in the next three to four months.

Carisma’s cell and gene therapies are based on a proprietary platform technology that reprograms a patient’s macrophages and targets them against cancer cells, with the potential for broad anti-tumor immunity. This novel technology is designed to engage with the body’s immune system to treat solid tumors, which remains a persistent clinical challenge that is yet to be comprehensively achieved through CAR-T and other immunotherapy approaches.

Carisma’s CAR-M platform provides the ability to fine-tune the specific targets of the immune cells, potentially enabling multiple therapeutic applications in and beyond oncology. The first clinical application of this technology is CT-0508, a CAR-M cell therapy currently being evaluated by Carisma in a Phase 1 multi-center clinical trial with a lead target indication of advanced HER2+ solid tumors. Carisma believes this Phase 1 clinical trial marks the first time that engineered macrophages are being studied in humans. Carisma is leveraging its proprietary CAR-M platform to expand its oncology pipeline both independently and through a strategic partnership with Moderna. Additionally, Carisma is exploring the potential to develop its proprietary macrophage engineering platform for non-oncology applications such as liver fibrosis, as well as autoimmune and neurodegenerative disease indications.

“The proposed merger represents an exciting opportunity for shareholders of each company, and we believe it gets us one step closer to our goal of revolutionizing the field of immunotherapy,” said Steven Kelly, President and Chief Executive Officer of Carisma. “This transaction will provide us with financial strength to not only continue to develop our lead candidate CT-0508, but also allow us to accelerate the growth of our platform and pipeline within and outside of oncology and develop additional strong strategic partnerships beyond those we already have with Moderna and Novartis. Carisma is focused on delivering cutting-edge technology for patients in a way that has never been done before, and we look forward to advancing this important mission.”

“This transaction represents the result of a thoughtful and careful review of strategic alternatives over the past four months, during which Carisma’s clinical programs, management team, and corporate strategy stood out amongst the 42 bids reviewed,” said Dr. Thomas Cannell, President and Chief Executive Officer of Sesen Bio. “Carisma is an exciting clinical-stage company with groundbreaking science and an impressive management team, which we believe makes them the optimal partner to provide value for our shareholders. Our mission at Sesen Bio has always been to save and improve the lives of patients with cancer, and we believe Carisma has the science and the unwavering patient focus required to make that mission a reality.”

Carisma has several anticipated upcoming catalysts and developmental milestones across its clinical programs over the next 18 months, including:

- Additional Phase 1 data readout of safety, manufacturing feasibility, and mechanism of action of CT-0508 with single-day dosing

- Completion of the technology transfer to Novartis for the planned clinical manufacturing of CT-0508

- Phase 1 data readout for the CT-0508 intraperitoneal trial for patients with HER2+ peritoneal cancer

- Phase 1 data readout of CT-0508 in combination with pembrolizumab for patients with HER2+ solid tumors

- Investigational New Drug (IND) Application for a new HER2 CAR engineered monocyte cell product

In addition to its exclusively licensed proprietary technologies that were developed by leading scientists at the University of Pennsylvania (Penn), including Saar Gill, MD, PhD, an associate professor of Medicine at Penn’s Perelman School of Medicine and a Carisma co-founder and fellow co-founder and Carisma’s Chief Scientific Officer, Dr. Michael Klichinsky, PharmD, PhD, Carisma has well-established strategic partners to support the advancement of its pipeline. Carisma recently entered into a strategic partnership with Moderna for the discovery, development and commercialization of in vivo CAR-M therapies for up to 12 targets for the treatment of cancer. As part of the collaboration, Carisma received a $45 million up-front cash payment and an investment by Moderna in the form of a $35 million convertible note, which will convert into shares of common stock of the combined company in connection with the merger. Under the collaboration, Carisma will receive full research funding and is eligible to receive development, regulatory, and commercial milestone payments, plus royalties on net sales of any products that are commercialized. Carisma has also partnered with Novartis, which has extensive experience in cell therapy manufacturing, to operate as Carisma’s contract manufacturing organization for clinical supply of its lead clinical program, CT-0508.

About the Proposed Merger

Pre-merger Sesen Bio stockholders are expected to own approximately 41.7% and pre-merger Carisma stockholders are expected to own approximately 58.3% of the combined company, in each case before giving effect to the concurrent financing described above and the conversion of the outstanding Moderna convertible note. Under the terms of the merger agreement, stockholders of Carisma will receive newly issued shares of Sesen Bio common stock pursuant to an exchange ratio formula set forth in the merger agreement. The percentage of the combined company that Sesen Bio stockholders will own upon the closing of the merger is further subject to adjustment based on the amount of Sesen Bio’s net cash at the time of closing.

Immediately prior to the closing of the proposed merger, Sesen Bio stockholders of record will be issued a contingent value right (CVR) for each outstanding share of Sesen Bio common stock held by such Sesen Bio stockholder as of such date, representing the right to receive certain cash payments from proceeds received by Sesen Bio related to the Roche Asset Purchase Agreement, if any, subject to customary deductions, including for expenses and taxes.

Following the consummation of the merger, the combined company will be headquartered in Philadelphia, Pennsylvania, and will be led by Steven Kelly, President and Chief Executive Officer of Carisma. Mr. Kelly was recently named Ernst & Young Entrepreneur of the Year 2022 Greater Philadelphia, an award that recognizes the most ambitious leaders who are building and sustaining successful, dynamic businesses around the world. The board of directors of the combined company is expected to be composed of seven members, consisting of one member designated by Sesen Bio and six members designated by Carisma.

The merger agreement has been unanimously approved by the boards of directors of both companies. The merger and related financing are expected to close in the next three to four months, subject to approval by Sesen Bio’s shareholders and other customary closing conditions.

Additional information about the transaction will be provided in a Current Report on Form 8-K that will be filed by Sesen Bio with the Securities and Exchange Commission (SEC) and will be available at www.sec.gov.

SVB Securities is acting as exclusive financial advisor to Sesen Bio for the transaction and Hogan Lovells US LLP is serving as its legal counsel. Evercore Group LLC is serving as lead financial advisor to Carisma for the transaction and BofA Securities, Inc. is also serving as financial advisor to Carisma for the transaction. Wilmer Cutler Pickering Hale and Dorr LLP is serving as legal counsel to Carisma. BofA Securities, Inc. and Evercore Group L.L.C. are serving as co-placement agents for Carisma’s concurrent financing and Shearman & Sterling LLP is serving as the placement agents’ legal counsel.

About Sesen Bio

Sesen Bio, Inc. is a late-stage clinical company focused on targeted fusion protein therapeutics for the treatment of patients with cancer. Sesen Bio’s most advanced product candidate, Vicineum™, also known as VB4-845, is a locally-administered targeted fusion protein composed of an anti-epithelial cell adhesion molecule antibody fragment tethered to a truncated form of Pseudomonas exotoxin A for the treatment of non-muscle invasive bladder cancer. On July 15, 2022, Sesen Bio made the strategic decision to voluntarily pause further development of Vicineum in the US. The decision was based on a thorough reassessment of Vicineum, which included the incremental development timeline and associated costs for an additional Phase 3 clinical trial, following Sesen Bio’s discussions with the United States Food and Drug Administration. Sesen Bio has turned its primary focus to assessing potential strategic alternatives with the goal of maximizing shareholder value. Additionally, Sesen Bio intends to seek a partner for the further development of Vicineum. For more information, please visit the Company’s website at www.sesenbio.com.

About Carisma Therapeutics

Carisma Therapeutics Inc. is a biopharmaceutical company dedicated to developing a differentiated and proprietary cell therapy platform focused on engineered macrophages, cells that play a crucial role in both the innate and adaptive immune response. The first applications of the platform, developed in collaboration with the University of Pennsylvania*, are autologous chimeric antigen receptor (CAR)-macrophages for the treatment of solid tumors. Carisma Therapeutics is headquartered in Philadelphia, PA. For more information, please visit www.carismatx.com

*Carisma has licensed certain Penn-owned intellectual property from the University of Pennsylvania, and Penn's Perelman School of Medicine receives sponsored research and clinical trial funding from Carisma. Penn and certain of its faculty members, including Dr. Gill, are current equity holders in Carisma and have received and may be entitled to receive future financial consideration from Carisma from the development and commercialization of products based on licensed Penn intellectual property.

Cautionary Note on Forward-Looking Statements

Any statements in this press release about future expectations, plans and prospects for Sesen Bio, Carisma or the combined company, Sesen Bio’s, Carisma’s or the combined company’s strategy or future operations, and other statements containing the words “anticipate,” “believe,” “contemplate,” “expect,” “intend,” “may,” “plan,” “predict,” “target,” “potential,” “possible,” “will,” “would,” “could,” “should,” “continue,” and similar expressions, constitute forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995. For example, statements concerning the proposed transaction, the concurrent financing, the contingent value rights and other matters, including without limitation: statements relating to the satisfaction of the conditions to and consummation of the proposed transaction, the expected timing of the consummation of the proposed transaction and the expected ownership percentages of the combined company, Sesen Bio’s and Carisma’s respective businesses, the strategy of the combined company, future operations, advancement of the combined company’s product candidates and product pipeline, clinical development of the combined company’s product candidates, including expectations regarding timing of initiation and results of clinical trials of the combined company, the ability of Sesen Bio to remain listed on the Nasdaq Stock Market, the completion of the concurrent financing, and the receipt of any payments under the contingent value rights are forward-looking statements. Actual results may differ materially from those indicated by such forward-looking statements as a result of various important factors, including without limitation: (i) the risk that the conditions to the closing of the proposed transaction are not satisfied, including the failure to obtain stockholder approval of matters related to the proposed transaction in a timely manner or at all; (ii) uncertainties as to the timing of the consummation of the proposed transaction and the ability of each of Sesen Bio and Carisma to consummate the proposed transaction, including completing the concurrent financing; (iii) risks related to Sesen Bio’s ability to correctly estimate its expected net cash at closing and Sesen Bio’s and Carisma’s ability to correctly estimate and manage their respective operating expenses and expenses associated with the proposed transaction; (iv) risks related to Sesen Bio’s continued listing on the Nasdaq Stock Market until closing of the proposed transaction; (v) the risk that as a result of adjustments to the exchange ratio, Sesen Bio stockholders or Carisma stockholders could own less of the combined company than is currently anticipated; (vi) the risk that the conditions to payment under the contingent value rights will not be met and that the contingent value rights may otherwise never deliver any value to Sesen Bio stockholders; (vii) risks associated with the possible failure to realize certain anticipated benefits of the proposed transaction, including with respect to future financial and operating results; (viii) uncertainties regarding the impact any delay in the closing would have on the anticipated cash resources of the combined company upon closing and other events and unanticipated spending and costs that could reduce the combined company’s cash resources; (ix) the occurrence of any event, change or other circumstance or condition that could give rise to the termination of the merger agreement; (x) the effect of the announcement, pendency or completion of the merger on Sesen Bio’s or Carisma’s business relationships, operating results and business generally; (xi) costs related to the merger; (xii) the outcome of any legal proceedings that may be instituted against Sesen Bio, Carisma or any of their respective directors or officers related to the merger agreement or the transactions contemplated thereby; (xiii) the ability of Sesen Bio or Carisma to protect their respective intellectual property rights; (xiv) competitive responses to the proposed transaction and changes in expected or existing competition; (xv) the success and timing of regulatory submissions and pre-clinical and clinical trials; (xvi) regulatory requirements or developments; (xvii) changes to clinical trial designs and regulatory pathways; (xviii) changes in capital resource requirements; (xix) risks related to the inability of the combined company to obtain sufficient additional capital to continue to advance its product candidates and its preclinical programs; (xx) legislative, regulatory, political and economic developments; and (xxi) other factors discussed in the “Risk Factors” section of Sesen Bio’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other reports filed with the SEC. In addition, the forward-looking statements included in this communication represent Sesen Bio’s and Carisma’s views as of the date hereof. Sesen Bio and Carisma anticipate that subsequent events and developments will cause the respective company’s views to change. However, while Sesen Bio may elect to update these forward-looking statements at some point in the future, Sesen Bio specifically disclaims any obligation to do so, except as required under applicable law. These forward-looking statements should not be relied upon as representing Sesen Bio’s views as of any date subsequent to the date hereof.

Important Additional Information

In connection with the proposed transaction, Sesen Bio will file materials with the SEC, including a registration statement on Form S-4 (Form S-4), which will include a document that serves as a proxy statement/prospectus of Sesen Bio and an information statement of Carisma, and other documents regarding the proposed transaction. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THESE MATERIALS, INCLUDING THE FORM S-4 AND THE PROXY STATEMENT/PROSPECTUS, WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES TO THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain the Form S-4, the proxy statement/prospectus and other materials filed by Sesen Bio with the SEC free of charge from the SEC’s website at www.sec.gov or from Sesen Bio at the SEC Filings section of www.sesenbio.com.

No Offer or Solicitation

This press release shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. Subject to certain exceptions to be approved by the relevant regulators or certain facts to be ascertained, a public offer will not be made directly or indirectly, in or into any jurisdiction where to do so would constitute a violation of the laws of such jurisdiction, or by use of the mails or by any means or instrumentality (including without limitation, facsimile transmission, telephone or internet) of interstate or foreign commerce, or any facility of a national securities exchange, of any such jurisdiction.

Participants in the Solicitation

Sesen Bio and Carisma and their respective directors, executive officers and other members of management may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information about Sesen Bio’s directors and executive officers is available in Sesen Bio’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021, its definitive proxy statement dated April 28, 2022 for its 2022 Annual Meeting of Stockholders and its Current Report on Form 8-K filed with the SEC on August 31, 2022. Other information regarding the participants in the proxy solicitation and a description of their interests in the transaction, by security holdings or otherwise, will be included in the proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the proposed transaction when they become available. Investors should read the proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents from Sesen Bio or the SEC’s website as indicated above.

Investors:

Erin Clark, Vice President, Corporate Strategy & Investor Relations

Carisma Media Contact:

Julia Stern

(763) 350-5223

Aignostics Raises €14m Series A to Advance AI-powered Pathology

Aignostics Raises €14m Series A to Advance AI-powered Pathology

- Oversubscribed financing round with top-tier life science investors, led by Wellington Partners

- Spin-off from Charité – Universitätsmedizin Berlin developing sophisticated AI models to improve understanding, diagnosis and treatment of complex diseases

- Funds to expand US market presence and further advance AI platform

Berlin, Germany, 15th September 2022

Aignostics, a spin-off from Charité – Universitätsmedizin Berlin, developing novel digital pathology solutions with “Explainable AI” for pharmaceutical research and diagnostics, today announced the closing of an oversubscribed €14m Series A financing round. Wellington Partners led the round, joined by existing investors Boehringer Ingelheim Venture Fund (BIVF), VC Fonds Technologie managed by IBB Ventures and High-Tech Gründerfonds (HTGF). CARMA Fund, initiated by Ascenion, also participated as a new investor.

While pathologists are outstanding at interpreting individual tissue samples qualitatively, deep analysis of large data sets is a challenge better suited for AI. Recognizing that, Aignostics focuses on building leading AI models for the detailed analysis of tissue samples and associated metadata for its blue-chip pharma and biotech clients. Aignostics’ AI models go well beyond current off-the-shelf solutions and established approaches. Their models cover key tissue staining technologies including hematoxylin-eosin (H&E), immunohistochemistry (IHC) and multiplex immunofluorescence (mIF). They enable the acceleration of pre-clinical and translational research to improve understanding of disease biology, mode of action, or novel biomarkers and drug response characteristics, which are difficult to assess with traditional approaches under a microscope.

“With this new round of funding, we want to continue building our presence and team. In particular, we will put a stronger focus on the US market, in which we have been active since the beginning of this year,” explained Viktor Matyas, CEO and co-founder of Aignostics. “By accelerating our investments into our platform and regulatory excellence, we will be able to offer a Good Clinical Practice (GCP) compliant development and analysis process starting early 2023, and we plan to have first AI models in use in early-stage clinical trials soon thereafter. Eventually, we aim to become a credible choice for global Companion Diagnostic (CDx) developments too.”

“In addition, we will continue driving innovation in machine learning research. For instance, our patented “Explainable AI” technology reverse engineers traditional black-box AI models and reveals features that its decisions and predictions are based on. This helps discover novel biomarkers or drug response characteristics. Moreover, we have developed a proprietary approach for the automated training of cell-level AI that does not rely on manual annotations by pathologists. Both approaches have successfully been deployed in client studies, and there are several more areas of research that we have identified as highly promising and impactful,” said Dr. Maximilian Alber, CTO and co-founder.

“What makes Aignostics unique is not just its technology, but also its comprehensive access to key data modalities and pathologists, who are closely involved in the development process at all times. This combination allows Aignostics to rapidly build bespoke pre-trained AI models that are highly impactful when used by its clients on their own research and clinical trial data,” said Dr. Johannes Fischer, Principal at Wellington Partners. The offering is “tissue centric”, meaning there is always a stained tissue sample at the core of the analysis, but often involving metadata and additional data modalities, such as molecular data or clinical data.

Dr. Alexander Ehlgen from Boehringer Ingelheim Venture Fund added: “We have been very pleased with the development of Aignostics over the last two years and believe the team has demonstrated the value it can add to its pharma and biotech clients. BIVF is therefore excited to continue supporting Aignostics’ growth and development, and in particular its research activities, as the Company builds out its market-leading technology and IP.”

Dr. Rainer Strohmenger, Managing Partner at Wellington Partners commented: “We are deeply impressed by the Aignostics team and technology. Wellington is excited to join the group of existing investors and to support a leading German AI player during its expansion phase. Even more than our previous portfolio company Definiens, Aignostics has the potential to transform how the pharmaceutical industry and CROs use pathology in their drug development process, with the goal to significantly advance treatments for patients with hard-to-treat diseases, including cancer.”

ABOUT AIGNOSTICS

Aignostics specializes in AI-powered pathology, uniquely combining proprietary technology, its pathologist network, and comprehensive access to key data modalities to build bespoke AI models for its global pharma and biotech client base. These AI models can deliver valuable insights into disease biology from tissue samples, such as novel biomarkers and drug response characteristics.

Aignostics formally started in 2018 in the Digital Health Accelerator program of the Berlin Institute of Health (BIH), based on joint research by Charité – Universitätsmedizin Berlin, one of Europe’s largest university hospitals, led by Prof. Frederick Klauschen, and TU Berlin, led by Prof. Klaus-Robert Müller. In early 2020, Aignostics was spun-out of Charité. To date, Aignostics has raised close to €20m in funding from leading VC investors and has offices in Berlin, Germany, and Boston, U.S.

Contact Media contact

Aignostics GmbH MC Services AG

Viktor Matyas, CEO Kaja Skorka, Dr. Regina Lutz

Phone: +49 89-210 2280

ABOUT WELLINGTON PARTNERS

Wellington Partners is a leading European venture capital firm investing in the most promising early- and growth stage life science companies in the fields of biotechnology, therapeutics, medical technology, diagnostics and digital health. With funds totalling more than €1.2 billion, thereof €590 million committed to life sciences, Wellington Partners has been actively supporting world class private companies translating true innovation into successful businesses with exceptional growth. To date, Wellington Partners has invested in 56 innovative life science companies, including Actelion (acquired by J&J), Definiens (acquired by AZ), immatics (Nasdaq: IMTX). invendo (acquired by Ambu), MTM Laboratories (acquired by Roche/Ventana), Oxford Immunotec (acquired by PerkinElmer), Rigontec (acquired by MSD), Symetis (acquired by Boston Scientific), and Themis (acquired by MSD).

ABOUT BOEHRINGER INGELHEIM VENTURE FUND GMBH

Created in 2010, the Boehringer Ingelheim Venture Fund GmbH (BIVF) invests in ground-breaking companies to drive innovation in biomedical research. BIVF is searching for significant enhancements in patient care through pioneering science and its clinical translation by building long-term relationships with scientists and entrepreneurs. BIVF’s focus is to target unprecedented concepts addressing high medical needs in immuno-oncology, regenerative medicine, infectious diseases and digital health. For more information, please visit:

www.boehringer-ingelheim-venture.com

ABOUT IBB VENTURES

IBB Ventures (www.ibbventures.de) has been providing venture capital to innovative Berlin-based companies since 1997 and has established itself as the market leader in early stage financing. The funds are primarily used for development and market launch of innovative products or services as well as for business concepts from creative industries. Two funds with a total volume of EUR 122 million are currently in the investment phase. Both VC funds are financed by the Investitionsbank Berlin (IBB) and the European Regional Development Fund (ERDF), managed by the State of Berlin. IBB Ventures has already invested in more than 260 creative and technology companies in Berlin; in syndicates with partners, the start-ups received approx. EUR 1.7 billion, of which IBB Ventures has invested EUR 250 million as lead, co-lead or co-investor.

ABOUT HIGH-TECH GRÜNDERFONDS

High-Tech Gründerfonds (HTGF) is a seed investor that finances high-potential, tech-driven start-ups. With around EUR 900 million in total investment volume across three funds and an international network of partners, HTGF has already helped forge more than 670 start-ups since 2005. With the start of HTGF IV, more than EUR 400 million in fund volume will be added in the fall of 2022. Driven by their expertise, entrepreneurial spirit and passion, its team of experienced investment managers and startup experts help guide the development of young companies. HTGF’s focus is on high-tech start-ups in the fields of digital tech, industrial technology, life sciences, chemistry and related business areas. To date, external investors have injected more than EUR 4 billion into the HTGF portfolio via more than 1,900 follow-on financing rounds. HTGF has also successfully sold interests in more than 160 companies.

Fund Investors in the public-private partnership include the Federal Ministry for Economic Affairs and Climate Action, KfW Capital, the Fraunhofer-Gesellschaft and many companies from a wide range of industries.

www.htgf.de

ABOUT CARMA FUND

CARMA FUND is an investment fund for the advancement of early-stage Life Science and Healthcare assets and companies. The fund is uniquely suited for young projects from the medical space with their extended development timelines due to its extra-long term and flexible investment modes. It started off with a First Closing of €47M in June 2022 and is based in Munich and Frankfurt.

ABOUT ASCENION GMBH

Ascenion is an independent technology transfer company focussing on the life sciences. It is partner to 30 research organizations, universities and university hospitals in Germany and Europe. Particular strengths are spin-off support and project development. In 2022 Ascenion initiated the CARMA FUND which invests in early-stage projects and start-ups in the life-science and healthcare sector. As technology transfer partner of the BIH and Charité Ascenion supported the founders and researchers in successfully implementing the spin-off from the BIH Digital Health Accelerator programme. In close cooperation with BIH, Ascenion also supported the negotiation of key agreements throughout the process and the series seed financing round.

ONWARD Reports Positive Topline Results from a Pivotal Study to Restore Arm and Hand Function in People with Spinal Cord Injury

ONWARD Reports Positive Topline Results from a Pivotal Study to Restore Arm and Hand Function in People with Spinal Cord Injury

THIS PRESS RELEASE CONTAINS INSIDE INFORMATION WITHIN THE MEANING OF ARTICLE 7(1) OF THE EUROPEAN MARKET ABUSE REGULATION (596/2014).

Up-LIFT study achieves primary endpoint: Statistically significant and clinically meaningful improvement in upper extremity strength and functioni i

Improvement in arm and hand function is the highest priority among people with tetraplegiaii ii

Up-LIFT is the first large-scale clinical study of non-invasive spinal cord stimulation technology

ONWARD plans to submit for marketing approval in the U.S. and Europe with the goal to launch ARC-EX Therapy in the second half of 2023

EINDHOVEN, the Netherlands, LAUSANNE, Switzerland, and BOSTON, MA USA—September 13, 2022–ONWARD Medical N.V. (Euronext: ONWD), the medical technology company creating innovative therapies to restore movement, independence, and health in people with spinal cord injury (SCI), today announced that the Up-LIFT pivotal study evaluating ARC-EX Therapy achieved its primary effectiveness endpoint of improvement in upper extremity strength and function. ARC-EX Therapy is a proprietary non-invasive spinal cord stimulation technology designed to restore movement and other functions in people with movement disabilities.

“The Up-LIFT study results represent a turning point in the field of spinal cord injury and paralysis science,” said Marco Baptista, Ph.D., Chief Scientific Officer of the Christopher & Dana Reeve Foundation. Functional recovery once deemed impossible may now be in reach. The Reeve Foundation looks forward to this technology advancing and, we hope, becoming widely available to our community.”

“Our vision is to empower people with spinal cord injury to enjoy life in every way that matters to them. Today’s excellent results from the Up-LIFT study will help us transform that vision into reality”, said Dave Marver, ONWARD CEO. “Our team is working hard to prepare regulatory submissions and toget ready for launch in the U.S. and Europe. We are hopeful we can begin to positively impact the lives of people with spinal cord injury sometime during the second half of 2023.”

“Restoring hand and arm function after spinal cord injury is life-changing, freeing people with paralysis to feed and care for themselves and be more independent in everyday activities,” said Chet Moritz, Ph.D., study co-Principal Investigator (co-PI) and Professor of Electrical & Computer Engineering and Rehabilitation Medicine at the University of Washington.

“We are grateful to the many therapists, clinicians, and people with SCI who participated in this landmark study. There was very low attrition over thousands of clinic visits, a testament to thecollective enthusiasm for this compelling therapy and for everyone’s determination to find new treatment options for people with SCI,” added Edelle Field-Fote, PT, Ph.D., FAPTA, FASIA, study co-PI, Director of SCI Research at the Shepherd Center in Atlanta, GA, and Professor at Emory University School of Medicine in the Department of Rehabilitation Medicine.

The Up-LIFT study is a prospective, single-arm pivotal study designed to evaluate the safety and effectiveness of non-invasive electrical spinal cord stimulation (ARC-EX Therapy) to treat upper extremity functional deficits in people with chronic tetraplegia (paralysis of all four limbs). The study enrolled 65 people at 14 leading SCI centers in the U.S., Europe, and Canada. Time since injury averaged 5.9 years (range 1 to 34 years) with an average subject age of 46.5 years. Detailed results will be made available after review by the FDA. The company plans to submit for regulatory approval in both the US and Europe within the next 6 months.

Participants completed an average of 50 training sessions over a period of about 4 months. A series of comprehensive assessments were performed at baseline and monthly thereafter to detect changes in sensory and motor function of upper extremities that directly translate into improved functional performance in activities of daily living. Rigorous measures such as CUE-T, GRASSP, ISNCSCI iii and pinch and grasp force were used to detect clinically meaningful changes resulting from the combination of ONWARD ARC-EX Therapy with a standard of care rehabilitation. An independent data safety monitoring board adjudicated the safe conduct of the study.

About Spinal Cord Injury

Spinal cord injury (SCI) represents a major unmet medical need for which there is no cure. Approximately 7 million people globally have a spinal cord injury, with over 650,000 in the U.S. and Europe alone. The quality of life of people with SCI can be poor, with paralysis and loss of sensation, issues with blood pressure control and trunk stability, increased potential for infection, incontinence, and loss of sexual function. Assistance is required for daily living activities. And SCI is costly, with the average lifetime cost for a paraplegic (paralysis of the legs) of $2.5 million and $5 million for a tetraplegic (paralysis of all four limbs). Treatments are urgently needed to restore movement and improve quality of life.

About ONWARD Medical

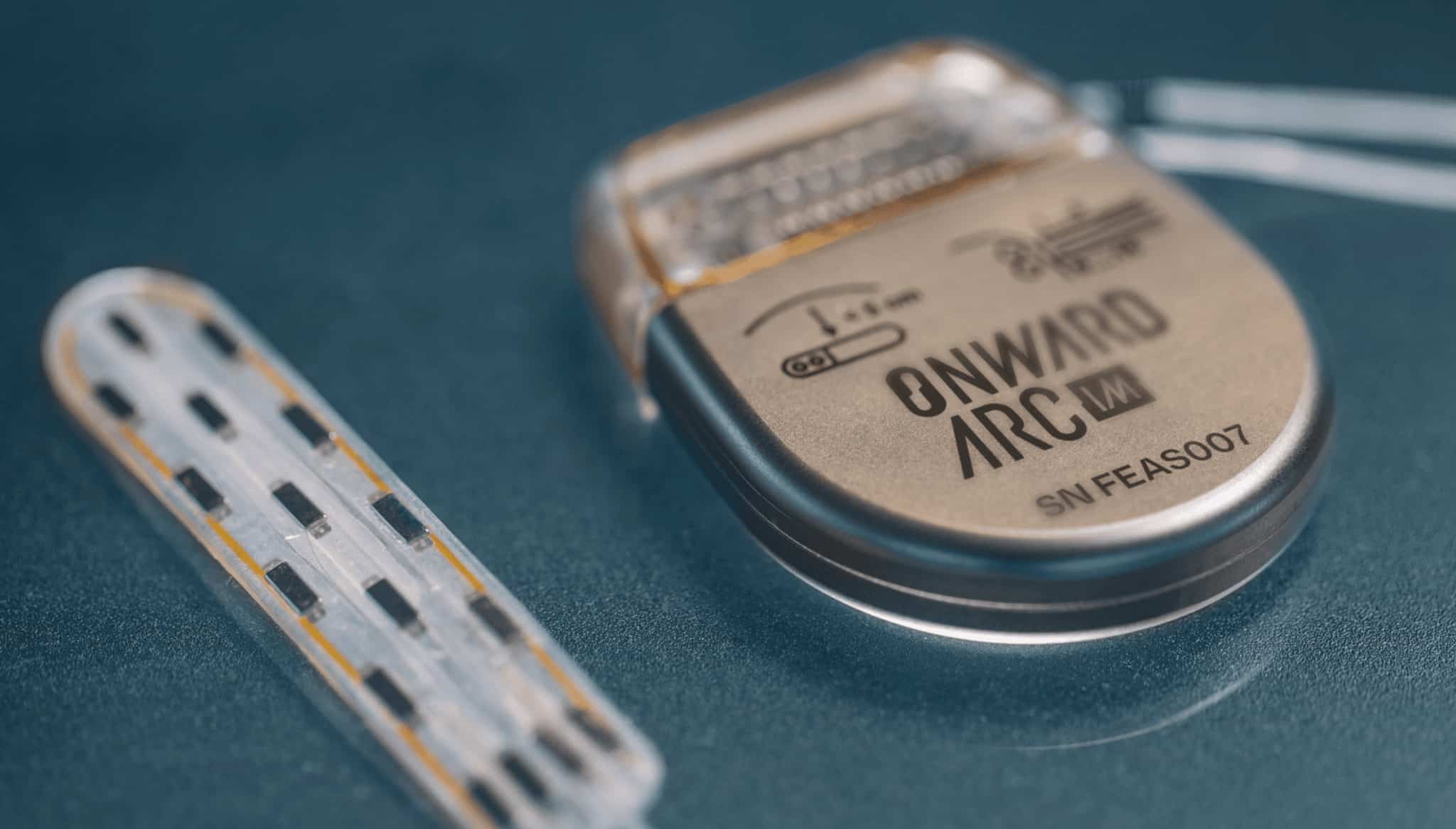

ONWARD is a medical technology company creating innovative therapies to restore movement, independence, and health in people with spinal cord injuries. ONWARD’s work builds on more than a decade of basic science and preclinical research conducted at the world’s leading neuroscience laboratories. ONWARD’s ARC Therapy, which can be delivered by implantable (ARC-IM) or external (ARC-EX) systems, is designed to deliver targeted, programmed spinal-cord stimulation to restore movement and other functions in people with spinal cord injury, ultimately improving their quality of life.

ONWARD has received three Breakthrough Device Designations from the U.S. FDA encompassing both ARC-IM and ARC-EX. ARC-EX is an external, non-invasive platform consisting of a wearable stimulator and wireless programmer. Topline data were reported in September 2022 from the company’s first pivotal study, called Up-LIFT, evaluating the ability of ARC-EX Therapy to improve upper extremity strength and function. The company is now preparing marketing approval submissions for the U.S. and Europe. ARC-IM consists of an implantable pulse generator and lead that is placed near the spinal cord. The company completed its first-in-human use of the ARC-IM neurostimulator in May 2022.

ONWARD is headquartered at the High Tech Campus in Eindhoven, the Netherlands. It maintains an office in Lausanne, Switzerland, and has a growing U.S. presence in Boston, Massachusetts, USA. For additional information about the company, please visit ONWD.com. To access our 2022

Financial Calendar, please visit IR.ONWD.com.

For Company Enquiries:

For Media Enquiries:

MC Services AG

US: Laurie Doyle, P: +1 339 832 0752

Europe: Dr. Johanna Kobler, Katja Arnold, Kaja Skorka P: +49 89 210 228 0

For Investor Enquiries:

Disclaimer

Certain statements, beliefs and opinions in this press release are forward-looking, which reflect the Company or, as appropriate, the Company directors’ current expectations and projections about future events. By their nature, forward-looking statements involve several risks, uncertainties, and assumptions that could cause actual results or events to differ materially from those expressed or implied by the forward-looking statements. These risks, uncertainties and assumptions could adversely affect the outcome and financial effects of the plans and events described herein. A multitude of factors including, but not limited to, changes in demand, competition, and technology, can cause actual events, performance, or results to differ significantly from any anticipated development. Forward-looking statements contained in this press release regarding past trends or activities should not be taken as a representation that such trends or activities will continue in the future. As a result, the Company expressly disclaims any obligation or undertaking to release any update or revisions to any forward-looking statements in this press release as a result of any change in expectations or any change in events, conditions, assumptions, or circumstances on which these forward-looking statements are based. Neither the Company nor its advisers or representatives nor any of its subsidiary undertakings or any such person’s officers or employees guarantees that the assumptions underlying such forward-looking statements are free from errors nor does either accept any responsibility for the future accuracy of the forward-looking statements contained in this press release or the actual occurrence of the forecasted developments. You should not place undue reliance on forward-looking statements, which speak only as of the date of this press release.

i Results pending review by FDA

ii Anderson KD. Targeting recovery: priorities of the spinal cord-injured population. J Neurotrauma. 2004

Oct;21(10):1371-83. doi: 10.1089/neu.2004.21.1371. PMID: 15672628.

iii ISNCSCI = International Standards for Neurological Classification of Spinal Cord Injury

GRASSP = The Graded Redefined Assessment of Strength, Sensation, and Prehension

CUE-T = The Capabilities of the Upper Extremity Test