Analyst (f/m/d) @ Wellington Partners Life Sciences

Analyst (f/m/d) @ Wellington Partners Life Sciences

Are you curious about how cutting-edge life science technologies become products that benefit patients? Would you like to become part of a venture firm, learn how to scout for new ideas, analyze technologies and business models, and create and support portfolio companies? If yes, then join wellingtonpartners as an Analyst in the Life Sciences Team.

We are looking for highly motivated additions to our life science investment team in Munich, with superb scientific and medical understanding and a strong desire to build a successful career in venture capital or related fields including the biotech/pharmaceutical/diagnostic/medical device industry. Successful applicants will join our team full-time either for an internship of at least 6 months or be directly considered for a permanent position.

Job Description

• Join the Investment team (full-time) in the Munich office.

• Document, screen and prioritize incoming deal flow of potential investment opportunities.

• Prepare and attend meetings with founders and management teams.

• Assist in the evaluation of investment opportunities through targeted research and benchmarking against standard of care.

• Prepare key analyses, e.g. compile information on disease areas, key product developments and competitor dynamics.

• Work with the team on consolidating key findings and forming the theses for prospective investments.

• Support the team on elements of the due diligence process as well as in the preparation of internal documentation for investment opportunities.

• Assist the team in general administration and in tasks arising from portfolio management, monitoring, and reporting.

Requirements

• A strong educational background in the Life Sciences or Medicine with above average exam grades is required (MSc / MD / PhD).

• Prior experience in business, bio-medical research or medicine is a plus.

• Affinity to financial analysis and evaluation of business models is a plus.

• Excellent written and verbal communication skills in English are required.

• Familiarity with standard office software (Word, Excel, PowerPoint) is needed.

• Munich location is required.

Personality

• Ambitious, hard-working, diligent personality and willingness to take responsibility.

• Curious, analytical, pro-active, self-motivated and eager to learn fast.

• Resourceful team player willing to support others to excel.

• Strong networker, outgoing person, that integrates well in multicultural environments.

Instructions

• Submit an application incl. a cover letter and CV using the Online Application form.

About

Based in Munich, wellingtonpartners is among the most successful pan-European Venture Capital firms. With currently more than € 600 million under management, we invest in early- to late-stage start-up companies throughout Europe that have the potential to become global leaders. Going forward we plan to further expand our investment activities in Life Sciences, an area where we have a leading position in the German-speaking countries and beyond.

Since 1998, Wellington Partners has invested in over 55 life science companies, including publicly listed firms such as Actelion (acquired by J&J), Oxford Immunotec (acquired by Perkin Elmer), immatics, 4SC, Carisma and ONWARD, as well as privately held companies such as Adrenomed, Aignostics, AMB, Amboss, Confo, Definiens (acquired by Medimmune/AstraZeneca), Dunad , eGenesis, invendo (acquired by Ambu), ImCheck, iOmx, Koa Health, Middle Peak Medical (acquired by Symetis/Boston Scientific), Minervax, MMI, mtm laboratories (acquired by Roche), nyra health, Perfect Vision (acquired by Bausch&Lomb), Quanta Dialysis Technologies, Rigontec (acquired by MSD), Sapiens (acquired by Medtronic), Seamless Therapeutics, Sidekick, SNIPR Biome, SphingoTec, STipe Therapeutics Symetis (acquired by Boston Scientific), Themis (acquired by MSD), TriCares and UroMems.

Investment Manager (f/m/d) @ Wellington Partners Life Sciences

Investment Manager (f/m/d) @ Wellington Partners Life Sciences

Are you curious about how cutting-edge life science technologies become products that benefit patients? Would you like to become part of a venture firm, learn how to scout for new ideas, analyze technologies and business models, and create and support portfolio companies? If yes, then join wellingtonpartners as an Investment Manager in the Life Sciences Team.

We are looking for highly motivated additions to our life science investment team in Munich, with superb scientific and medical understanding and a strong desire to build a successful career in venture capital or related fields including the biotech/pharmaceutical/diagnostic/medical device industry. Successful applicants will join our team full-time in the Munich office.

Job Description

• Join the Investment team (full-time) in the Munich office.

• Identify and evaluate life science investment opportunities for Wellington Partners.

• Work closely with and support the investment team on elements of the due diligence and task arising from new investments.

• Support the investment team in trade sales and IPO processes.

• Work with the team in general administration of the funds under management and in tasks arising from portfolio management, monitoring, and reporting.

• Develop a network of private and institutional investors, incubators, research organizations, consultants, and industry experts.

Requirements

• A strong educational background in Medicine or the Life Sciences with above average exam grades is required (MSc / MD / PhD).

• Previous work experience (2-4 years) in related industries is required.

• Previous experience in bio-medical research or medicine is a plus.

• Strong interest in investments, capital markets, business models and finance is needed.

• Excellent written and verbal communication skills in English are required.

• Familiarity with standard office software (Word, Excel, PowerPoint) is needed.

• Munich location is required.

Personality

• Ambitious, hard-working, diligent personality and willingness to take responsibility.

• Curious, analytical, pro-active, self-motivated and eager to learn fast.

• Resourceful team player willing to support others to excel.

• Strong networker, outgoing person, that integrates well in multicultural environments.

Instructions

• Submit an application incl. a cover letter and CV using the Online Application form.

About

Based in Munich, wellingtonpartners is among the most successful pan-European Venture Capital firms. With currently more than € 600 million under management, we invest in early- to late-stage start-up companies throughout Europe that have the potential to become global leaders. Going forward we plan to further expand our investment activities in Life Sciences, an area where we have a leading position in the German-speaking countries and beyond.

Since 1998, Wellington Partners has invested in over 55 life science companies, including publicly listed firms such as Actelion (acquired by J&J), Oxford Immunotec (acquired by Perkin Elmer), immatics, 4SC, Carisma and ONWARD, as well as privately held companies such as Adrenomed, Aignostics, AMB, Amboss, Confo, Definiens (acquired by Medimmune/AstraZeneca), Dunad , eGenesis, invendo (acquired by Ambu), ImCheck, iOmx, Koa Health, Middle Peak Medical (acquired by Symetis/Boston Scientific), Minervax, MMI, mtm laboratories (acquired by Roche), nyra health, Perfect Vision (acquired by Bausch&Lomb), Quanta Dialysis Technologies, Rigontec (acquired by MSD), Sapiens (acquired by Medtronic), Seamless Therapeutics, Sidekick, SNIPR Biome, SphingoTec, STipe Therapeutics Symetis (acquired by Boston Scientific), Themis (acquired by MSD), TriCares and UroMems.

MMI Receives FDA Authorization to Commercialize Symani® Surgical System in the U.S.

MMI Receives FDA Authorization to Commercialize Symani® Surgical System in the U.S.

De Novo Classification builds on proven clinical success and expands global access to new category of treatments

JACKSONVILLE, Fla. – April 8, 2024 – MMI (Medical Microinstruments, Inc.), a robotics company dedicated to increasing treatment options and improving clinical outcomes for patients with complex conditions, today announced that its Symani Surgical System is now commercially available in the United States. The U.S. Food and Drug Administration (FDA) granted De Novo Classification to the robotic system for soft tissue manipulation to perform microsurgery, a highly specialized technique that involves reconnecting tiny vessels to restore blood flow or redirect fluid during reconstruction or repair.

The FDA authorization makes the Symani Surgical System the only commercially available platform in the U.S. for reconstructive microsurgery. The technology is positioned to open the field of microsurgery to new surgeons by quickly developing their skills, as well as to empower skilled microsurgeons to confidently expand into supermicrosurgery, creating a novel category of treatments that the human hand cannot perform without robotic assistance.

“The U.S. is facing a potentially dire shortage of physicians, and that shortage acutely impacts specialized fields of medicine, such as microsurgery,” said Mark Toland, CEO of MMI. “With the authorization from the FDA, our technology will expand its reach to pioneering hospitals in the U.S. It will help those hospitals grow their open surgical programs, expand the number of physicians who can perform these highly complicated procedures, and increase patient access to the most advanced techniques for surgeries in complex disease states, such as lymphedema. Our system will continue to provoke surgeons to challenge their definitions of ‘treatable’ and ‘untreatable’ and empower them to solve cases that have historically been too difficult to treat.”

Specific techniques used in microsurgery include reconnecting small anatomical structures, such as blood and lymphatic vessels, during open surgical procedures. Supermicrosurgery involves reconstruction or repair of even smaller vessels, typically less than 1mm in diameter, and fewer than 600 surgeons worldwide perform supermicrosurgery today.

The Symani Surgical System provides advanced solutions for a range of open surgeries, including post-mastectomy breast cancer reconstruction, extremity reconstruction using free tissue transfer, and lymphatic system repair.

“By making open surgery less invasive and more precise, we can treat more conditions and offer robotic-assisted surgical options to patients that simply do not exist today,” said Dr. L. Scott Levin, co-CMO of MMI. “Within the next five years, this expanded portfolio of addressable open surgical procedures is expected to exceed the number of eligible laparoscopic, or minimally invasive, procedures that leverage robotic assistance. The authorization from the FDA helps to solve a critical unmet need and will help surgeons perform a new category of complex open surgeries enabled by transformative technology.”

The Symani Surgical System offers surgeons entirely new capabilities because it features the world’s smallest surgical robotic wrist, called NanoWrist®. The unique design enables surgeons to replicate the natural movements of the human hand at the micro scale, which encourages a flatter learning curve in the training process. The articulated wrist features seven degrees of freedom that match the human wrist, tremor filtration and motion scaling, ultimately increasing precision and control.

Surgeons have leveraged the Symani Surgical System in nearly 1,000 clinical cases in the European Union and in thousands of preclinical cases around the world. The Symani Surgical System is available for commercial use in Europe and parts of Asia Pacific. MMI plans to immediately launch the technology in the U.S.

To learn more about MMI and the Symani Surgical System, visit MMI’s website here: https://mmimicro.com.

MMI (Medical Microinstruments, Inc.) is on a mission to advance robotic technology that pushes the limits of soft tissue open surgery and opens new opportunities for surgeons to restore quality of life for more patients with complex conditions. The company was founded in 2015 near Pisa, Italy, and its proprietary Symani® Surgical System combines the world’s smallest wristed microinstruments with tremor-reducing and motion-scaling technologies to address significant unmet patient needs across the globe. This first-of-its-kind surgical robotic platform for open, soft tissue micro-level surgery can help address microvascular repair and lymphatic repair. In Europe, it also addresses peripheral nerve repair. The Symani System is authorized for use in the U.S. by the FDA and is a CE Marked medical device in Europe. MMI is backed by global investors including Fidelity Management & Research Company, Andera Partners, BioStar, Deerfield Management, Fountain Healthcare Partners, Panakès Partners, RA Capital, Sambatech, and Wellington Partners.

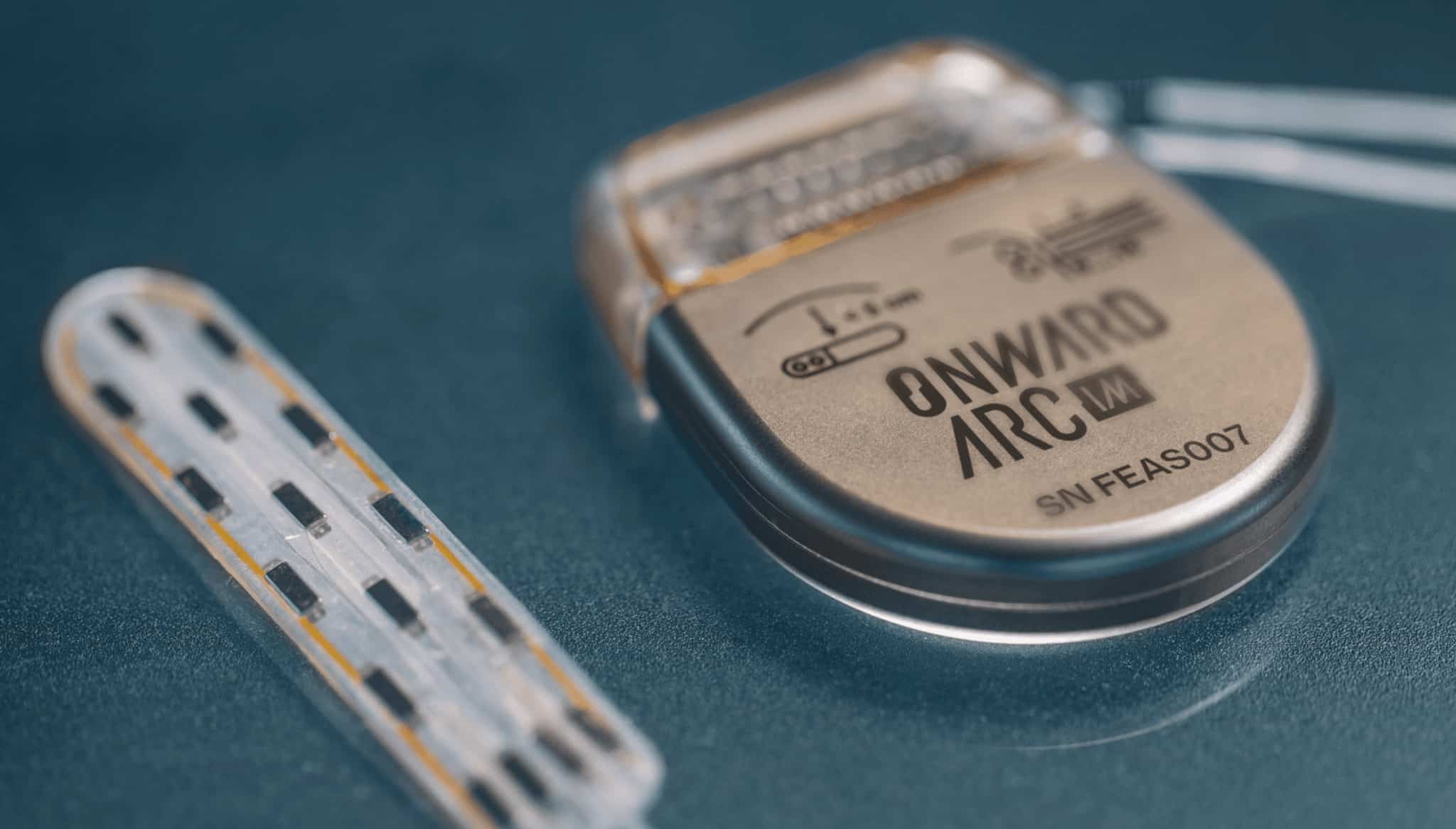

ONWARD® Medical Submits De Novo Application to FDA for its ARC-EX® System

THIS PRESS RELEASE CONTAINS INSIDE INFORMATION WITHIN THE MEANING OF ARTICLE 7(1) OF THE EUROPEAN MARKET ABUSE REGULATION (596/2014)

ONWARD® Medical Submits De Novo Application to FDA for its ARC-EX® System

FDA clearance would allow the Company to market its breakthrough therapy to improve or restore hand and arm function after spinal cord injury in the US

EINDHOVEN, the Netherlands — April 2, 2024 — ONWARD Medical N.V. (Euronext: ONWD), the medical technology company creating innovative spinal cord stimulation therapies to improve or restore movement, function, and independence in people with spinal cord injury (SCI), today announces it has submitted its De Novo application to the US Food and Drug Administration (FDA) to allow marketing of its breakthrough ARC-EX System to restore function of the upper extremities after SCI.

The submission marks an historic milestone for the Company in its mission to restore mobility and function for people with SCI. Once cleared by the FDA, ARC-EX will be the first-ever spinal cord stimulation therapy to restore hand and arm function after SCI and the first commercial product for ONWARD Medical. ONWARD prioritized upper limb function as its first indication for the ARC-EX System given feedback from the SCI Community of the importance of arm, hand, and finger function in empowering independence after SCI.

“We are delighted to be one step closer to bringing our breakthrough ARC-EX System to people living with SCI after submitting this De Novo application for regulatory clearance in the United States,” said ONWARD Medical CEO Dave Marver. “This therapy has the potential to transform the lives of people living with paralysis, while also positively impacting their loved ones.”

The De Novo application follows the Company’s global pivotal study – called Up-LIFT – the first large-scale pivotal study of transcutaneous spinal cord stimulation. The study investigated the safety and effectiveness of ARC-EX Therapy in improving upper limb strength and function in 65 study participants with chronic tetraplegia at 14 leading SCI neurorehabilitation centers in the United States, Canada, the United Kingdom, and the Netherlands. The study met all primary safety and effectiveness endpoints and demonstrated that 72% of participants responded to ARC-EX Therapy1, showing improvement both in strength and function.

“The SCI Community is eager to have access to this innovative technology,” said Candy Tefertiller, PT, DPT, PhD, NCS, Executive Director of Research and Evaluation, Craig Hospital in Lakewood, Colorado. “Even a small difference in hand and arm function can have a profound impact on independence and quality of life. The results of the Up-LIFT trial that led to this submission represent a significant advancement in the use of neuromodulation for individuals with spinal cord injury.”

The ONWARD ARC-EX System delivers ARC-EX Therapy™ – targeted, programmed electrical stimulation – transcutaneously to the spinal cord to increase strength, movement, and function of the upper limbs after SCI. The ARC-EX System was previously awarded FDA Breakthrough Device Designation (BDD) for upper limb function, which provided prioritized FDA review, the opportunity to interact with FDA experts, and the potential for additional reimbursement.

Nearly 200,000 people in the US and Europe have incomplete impaired upper extremity function after spinal cord injury.2,3 The Company is preparing for regulatory submission in Europe next.

To learn more about ONWARD Medical’s commitment to partnering with the SCI Community to develop innovative solutions for restoring movement, function, and independence after spinal cord injury, please visit ONWD.com.

*All ONWARD Medical devices and therapies, including but not limited to ARC-IM®, ARC-EX®, ARCBCI™, and ARC Therapy™, alone or in combination with a brain-computer interface (BCI), are investigational and not available for commercial use.

About ONWARD Medical

ONWARD Medical is a medical technology company creating therapies to restore movement, function, and independence in people with spinal cord injury (SCI) and movement disabilities. Building on more than a decade of science and preclinical research conducted at leading neuroscience laboratories, the Company has received ten Breakthrough Device Designations from the US Food and Drug Administration for its ARC Therapy™ platform.

ONWARD® ARC Therapy, which can be delivered by external ARC-EX® or implantable ARC-IM® systems, is designed to deliver targeted, programmed spinal cord stimulation. Positive results were presented in 2023 from the Company’s pivotal study, called Up-LIFT, evaluating the ability for transcutaneous ARC Therapy to improve upper extremity strength and function. The Company has submitted its De Novo regulatory clearance submission for ARC-EX for the US and is preparing for regulatory submission in Europe. In parallel, the Company is conducting studies with its implantable ARC-IM platform, which

demonstrated positive interim clinical outcomes for improved blood pressure regulation, a component of hemodynamic instability, following SCI. Other ongoing studies include combination use of ARC-IM with a brain-computer interface (BCI) to address multiple symptoms of SCI.

Headquartered in Eindhoven, the Netherlands, ONWARD Medical has a Science and Engineering Center in Lausanne, Switzerland and a US office in Boston, Massachusetts. The Company also has an academic partnership with .NeuroRestore, a collaboration between the Swiss Federal Institute of Technology

(EPFL), and Lausanne University Hospital (CHUV).

ONWARD Medical is listed on Euronext Brussels and Amsterdam (ticker: ONWD).

For more information, visit ONWD.com, and connect with us on LinkedIn and YouTube.

For Media Enquiries:

Aditi Roy, VP Communications

For Investor Enquiries:

Khaled Bahi, Interim CFO

Disclaimer

Certain statements, beliefs, and opinions in this press release are forward-looking, which reflect the Company’s or, as appropriate, the Company directors’ current expectations and projections about future events. By their nature, forward-looking statements involve several risks, uncertainties, and assumptions

that could cause actual results or events to differ materially from those expressed or implied by the forward-looking statements. These risks, uncertainties, and assumptions could adversely affect the outcome and financial effects of the plans and events described herein. A multitude of factors including, but not limited to, changes in demand, competition, and technology, can cause actual events, performance, or results to differ significantly from any anticipated development. Forward-looking statements contained in this press release regarding past trends or activities should not be taken as a representation that such trends or activities will continue in the future. As a result, the Company expressly disclaims any obligation or undertaking to release any update or revisions to any forward-looking statements in this press release as a result of any change in expectations or any change in events, conditions, assumptions, or circumstances on which these forward-looking statements are based. Neither the Company nor its advisers or representatives nor any of its subsidiary undertakings or any such person’s officers or employees guarantees that the assumptions underlying such forward-looking statements are free from errors nor does either accept any responsibility for the future accuracy of the forward-looking statements contained in this press release or the actual occurrence of the forecasted developments. You should not place undue reliance on forward-looking statements, which speak only as of the date of this press release. All ONWARD Medical devices and therapies referenced here, including but not limited to ARC-IM®, ARC-EX®, ARC-BCI™ and ARC Therapy™, are investigational and not available for commercial use.

Carisma Therapeutics Announces Changes to its Board of Directors

Carisma Therapeutics Announces Changes to its Board of Directors

Appointment of John Hohneker, M.D.

Resignation of Chidozie Ugwumba

PHILADELPHIA, April 1, 2024 /PRNewswire/ — Carisma Therapeutics Inc. (Nasdaq: CARM) (“Carisma” or the “Company”), a clinical-stage biopharmaceutical company focused on discovering and developing innovative immunotherapies, today announced the appointment of John Hohneker, M.D. to the Board of Directors of the Company, effective April 1, 2024. Additionally, the Company announced that Chidozie Ugwumba, who has served on Carisma’s Board of Directors since December 2020, has advised the Board of his intent to step down from his role as a member of the Board and chair of the Audit Committee of the Board effective April 1, 2024, as a result of his other professional commitments.

“We are pleased to welcome John to the Carisma Board of Directors,” said Sanford Zweifach, Chair of the Carisma Board of Directors. “I believe John’s extensive track record of clinical development, strategic leadership, and public company Board membership in the biopharmaceutical space will enable him to immediately support the Company as it continues leading the field of engineered macrophage development. We would also like to thank Chidozie for his invaluable advice and guidance since he first joined the Board over three years ago.”

“I am excited to join Carisma’s Board as the Company continues to develop innovative immunotherapies,” said Dr. Hohneker. “I am looking forward to partnering with the Board and the management team as they work to potentially bring novel treatments to patients in need across multiple therapeutic areas.”

Dr. Hohneker brings over 30 years of extensive experience in drug development and leadership across the biotech and pharmaceutical sectors. He most recently served as President and Chief Executive Officer of Anokion SA. Prior to this, he held the role of President of Research and Development at FORMA Therapeutics Inc. Before joining FORMA Therapeutics, Dr. Hohneker held roles of increasing responsibility at Novartis AG, including most recently as Senior Vice President and Global Head of Development, Immunology, and Dermatology. Prior to his time at Novartis, Dr. Hohneker held positions of increasing responsibility at Glaxo Wellcome and its legacy company, Burroughs Wellcome.

Dr. Hohneker currently serves on the Board of Directors of Curis, Inc., Sonata Therapeutics, Inc., and Trishula Therapeutics, Inc. Previously, Dr. Hohneker has served as a member of the Board of Directors of Torque Therapeutics, Inc., Dimension Therapeutics, Inc., Cygnal Therapeutics, Inc., BioTheryX Inc., Evelo Biosciences, Inc., Humanigen, Inc. and Aravive, Inc. Dr. Hohneker received his bachelor’s degree in chemistry from Gettysburg College and his M.D. from the Rutgers School of Biomedical and Health Sciences (formerly the University of Medicine and Dentistry of New Jersey-Rutgers Medical School). He completed his internship and residency in internal medicine and his fellowship in medical oncology, all at the University of North Carolina at Chapel Hill.

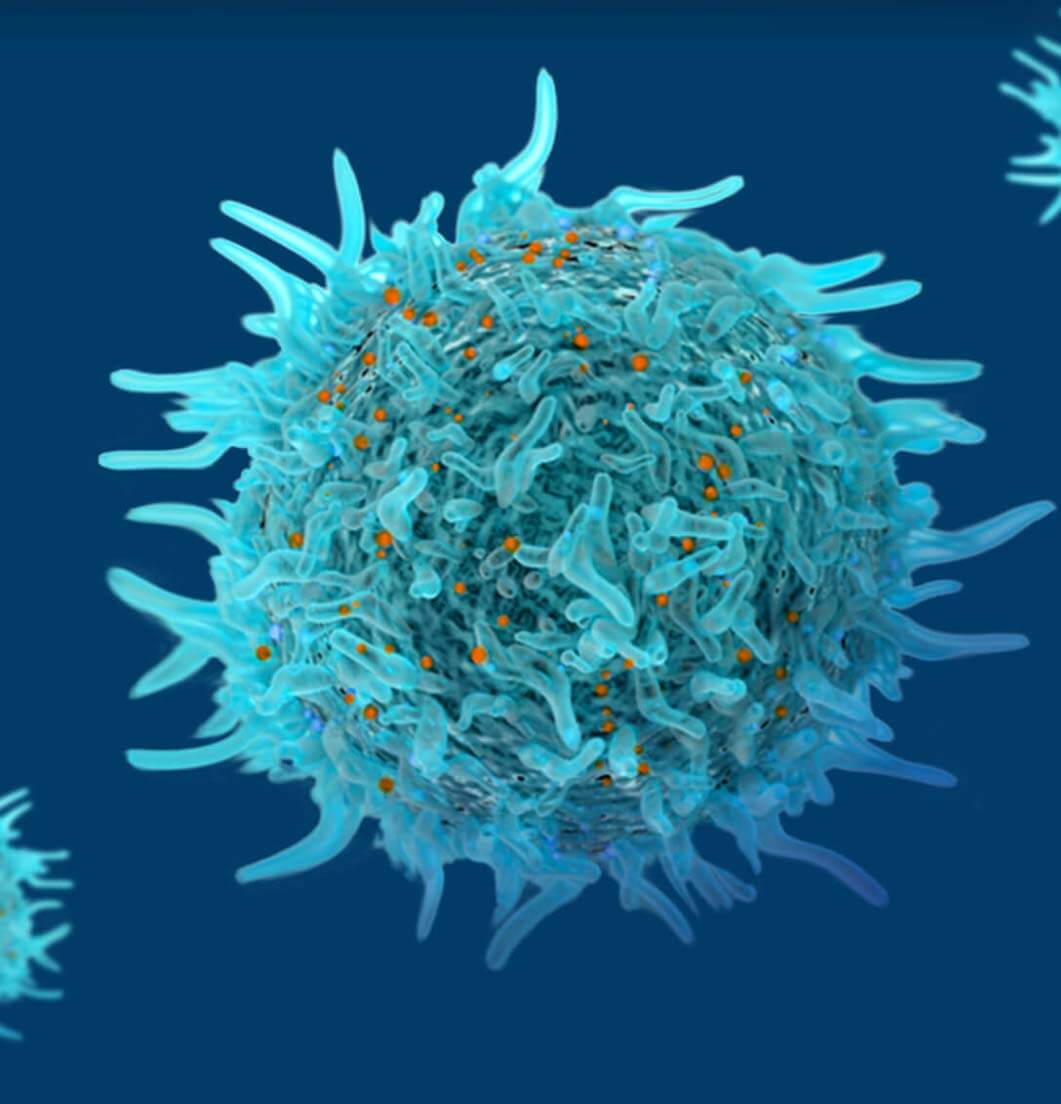

About Carisma

Carisma Therapeutics Inc. is a clinical-stage biopharmaceutical company focused on utilizing our proprietary macrophage and monocyte cell engineering platform to develop transformative immunotherapies to treat cancer and other serious diseases. We have created a comprehensive, differentiated proprietary cell therapy platform focused on engineered macrophages and monocytes, cells that play a crucial role in both the innate and adaptive immune response. Carisma is headquartered in Philadelphia, PA. For more information, please visit www.carismatx.com.