Immatics Receives FDA Regenerative Medicine Advanced Therapy (RMAT) Designation for ACTengine® IMA203 TCR-T Monotherapy

Immatics Receives FDA Regenerative Medicine Advanced Therapy (RMAT) Designation for ACTengine® IMA203 TCR-T Monotherapy

- RMAT designation granted by FDA CBER for IMA203 cell therapy in multiple PRAME-expressing tumors including cutaneous and uveal melanoma, ovarian cancer and other cancer types

- Regulatory activities underway with an initial focus on a registration-directed trial in melanoma as step one to leverage the full breadth of PRAME

Houston, Texas and Tuebingen, Germany, October 24, 2023 – Immatics N.V. (NASDAQ: IMTX, “Immatics”), a clinical-stage biopharmaceutical company active in the discovery and development of T cell-redirecting cancer immunotherapies, today announced that its IMA203 TCR-T program has received Regenerative Medicine Advanced Therapy (RMAT) designation from the FDA Center for Biologics Evaluation and Research (CBER) in multiple relapsed and/or refractory HLA-A*02:01-positive and PRAME-expressing cancers, including cutaneous melanoma, uveal melanoma, endometrial carcinoma, synovial sarcoma, and ovarian cancer. IMA203 is a TCR-T cell therapy targeting PRAME, a protein frequently expressed in a large variety of solid tumors.

“The FDA RMAT designation for multiple indications underscores the broad potential of IMA203 and the benefits it may provide for advanced-stage solid tumor patients. This is an important regulatory milestone and a recognition of our clinical development progress for this program,” said Cedrik Britten, Chief Medical Officer of Immatics. “The close support from the FDA resulting from the RMAT status enhances our efforts to accelerate bringing IMA203 to cancer patients by enabling real-time discussions on patient populations, trial design and CMC.”

Established under the 21st Century Cures Act, RMAT designation is a dedicated program designed to expedite the development and review processes for promising pipeline products, including cell therapies, that includes all the benefits of Fast Track and Breakthrough designation programs. An investigational cell therapy is eligible for RMAT designation if it meets the definition of regenerative medicine therapy, it is intended to treat, modify, reverse, or cure a serious or life-threatening disease; and preliminary clinical evidence indicates that the therapy has the potential to address unmet medical needs for that disease. Advantages of the RMAT designation include early interactions with the FDA that may be used to discuss potential surrogate or intermediate endpoints for accelerated approval and potential ways to satisfy post-approval requirements, potential priority review of the biologics license application (BLA) and other opportunities to expedite development and review.

Based on publicly available information1, it is the Company’s understanding that this is the first time that FDA has granted a RMAT designation for an oncology drug candidate for more than two solid tumor indications. As of Sep 30, 2023, the U.S. FDA has received at least 238 requests for RMAT designations and granted 922.

About IMA203 and target PRAME

ACTengine® IMA203 T cells are directed against an HLA-A*02:01-presented peptide derived from preferentially expressed antigen in melanoma (PRAME), a protein frequently expressed in a large variety of solid cancers, thereby supporting the program’s potential to address a broad cancer patient population. Immatics’ PRAME peptide is present at a high copy number per tumor cell and is homogeneously and specifically expressed in tumor tissue. The peptide has been identified and characterized by Immatics’ proprietary mass spectrometry-based target discovery platform, XPRESIDENT®. Through its proprietary TCR discovery and engineering platform XCEPTOR®, Immatics has generated a highly specific T cell receptor (TCR) against this target for its TCR-based cell therapy approach, ACTengine® IMA203.

ACTengine® IMA203 TCR-T is currently being evaluated in three ongoing Phase 1b dose expansion cohorts in last-line patients: Cohort A IMA203 GEN1 monotherapy, Cohort B IMA203 in combination with an immune checkpoint inhibitor (deprioritized) and Cohort C IMA203CD8 GEN2 monotherapy, where IMA203 engineered T cells are co-transduced with a CD8αβ co-receptor.

About ACTengine®

ACTengine® is a personalized cell therapy approach for patients with advanced solid tumors. The patient’s own T cells are genetically engineered to express a novel, proprietary TCR directed against a defined cancer target. The modified T cells are then reinfused into the patient to attack the tumor. The approach is also known as TCR-engineered cell therapy (TCR-T). All Immatics’ ACTengine® product candidates can be rapidly manufactured utilizing a proprietary manufacturing process designed to enhance T cell engraftment and persistence in vivo.

The ACTengine® T cell products are manufactured at the Evelyn H. Griffin Stem Cell Therapeutics Research Laboratory in collaboration with UTHealth.

– END –

About Immatics

Immatics combines the discovery of true targets for cancer immunotherapies with the development of the right T cell receptors with the goal of enabling a robust and specific T cell response against these targets. This deep know-how is the foundation for our pipeline of Adoptive Cell Therapies and TCR Bispecifics as well as our partnerships with global leaders in the pharmaceutical industry. We are committed to delivering the power of T cells and to unlocking new avenues for patients in their fight against cancer.

Immatics intends to use its website www.immatics.com as a means of disclosing material non-public information. For regular updates, you can also follow us on Twitter, Instagram and LinkedIn.

Forward-Looking Statements:

Certain statements in this press release may be considered forward-looking statements. Forward-looking statements generally relate to future events or Immatics’ future financial or operating performance. For example, statements concerning the timing of product candidates and Immatics’ focus on partnerships to advance its strategy are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expect”, “intend”, “will”, “estimate”, “anticipate”, “believe”, “predict”, “potential” or “continue”, or the negatives of these terms or variations of them or similar terminology. Such forward-looking statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed or implied by such forward looking statements. These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by Immatics and its management, are inherently uncertain. New risks and uncertainties may emerge from time to time, and it is not possible to predict all risks and uncertainties. Factors that may cause actual results to differ materially from current expectations include, but are not limited to, various factors beyond management’s control including general economic conditions and other risks, uncertainties and factors set forth in filings with the SEC. Nothing in this press release should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. Immatics undertakes no duty to update these forward-looking statements. All the scientific and clinical data presented within this press release are – by definition prior to completion of the clinical trial and a clinical study report – preliminary in nature and subject to further quality checks including customary source data verification.

For more information, please contact:

| Media | |

| Eva Mulder or Charlotte Spitz | |

| Trophic Communications | |

| Phone: +31 65 2331 579 | |

| Investor Relations | |

| Sabrina Schecher, Ph.D. | |

| Senior Director, Investor Relations | |

| Phone: +49 89 262002433 | |

1 Source: https://bioinformant.com/rmat/

2 Source: FDA – https://www.fda.gov/vaccines-blood-biologics/cellular-gene-therapy-products/cumulative-cber-regenerative-medicine-advanced-therapy-rmat-designation-requests-received-fiscal

MinervaX Raises EUR 54M in Upsized Financing to Advance the Development of its Maternal Vaccine Against Group B Streptococcus

MinervaX Raises EUR 54M in Upsized Financing to Advance the Development of its Maternal Vaccine Against Group B Streptococcus

- New investment from EQT Life Sciences and OrbiMed with participation from existing investors

- MinervaX will hold financial reserves of more than €125 million, following the financing

- The financing supports the Company’s efforts to commence a Phase III clinical trial of its Maternal Vaccine against Group B Streptococcus

Copenhagen, Denmark, 11 October 2023 – MinervaX ApS, a privately held Danish biotechnology company developing a novel, prophylactic vaccine against Group B Streptococcus (GBS), has today announced the completion of a EUR 54 million upsized financing. The financing includes investment from new investors EQT Life Sciences and OrbiMed, with participation from existing investors Novo Holdings, Pureos Ventures, Sanofi Ventures, Trill Impact Ventures, Adjuvant Capital, Wellington Partners, Industrifonden, Sunstone LifeScience Ventures, and LF Invest. Vincent Brichard of EQT Life Sciences and Tal Zaks of OrbiMed will join the MinervaX Board of Directors.

GBS is a leading cause of life-threatening infections in newborns as well as adverse pregnancy outcomes such as preterm delivery and stillbirths. Current prophylactic measures provide insufficient protection, meaning there is an urgent need to accelerate the development of a GBS vaccine. A video describing the unmet medical need for a GBS vaccine and details of MinervaX’s novel GBS maternal vaccine can be found on the Company’s website, here: https://youtu.be/HvkRJBqsjjY.

The Company is currently progressing two Phase II clinical trials in 470 pregnant persons across Denmark, United Kingdom, Uganda and South Africa. Initial data from these clinical trials are highly positive and demonstrate that the vaccine has an acceptable safety profile, is highly immunogenic and gives rise to functionally active antibodies. Details of MinervaX’s clinical trials can be found at clinicaltrials.gov under the identifiers NCT04596878 and NCT05154578. In addition to pregnant persons, MinervaX is also pursuing Phase I development of its novel GBS vaccine in Older Adults, under identifier NCT05782179.

This financing will enable MinervaX to progress its novel GBS vaccine towards Phase III clinical trials in 2024.

Per Fischer, CEO of MinervaX, said: “The addition of EQT Life Sciences and OrbiMed to our existing investor consortium further strengthens the Company’s resolve to advance our novel GBS vaccine towards Phase III clinical trials in pregnant persons. It also provides additional validation and recognition of the acceptable safety profile and strong data demonstrated in the Phase II clinical trials. We are delighted to welcome Vincent Brichard and Tal Zaks to the board of directors, who will bring invaluable vaccine expertise as we continue to address the pressing need for the development of a novel vaccine to address the unmet medical burden of Group B Streptococcus.”

Vincent Brichard, Venture Partner EQT Life Sciences, commented: “EQT Life Sciences is thrilled to take an active part in the MinervaX prophylactic vaccine against GBS with the hope to save newborns’ lives. We are impressed by the clinical data achieved so far, the quality of the team and the near-term milestones enabling MinervaX to start a registration trial.”

Tal Zaks, Partner at OrbiMed, added: “We recognize the unmet need for better protection against GBS disease for vulnerable populations and the potential for MinervaX’s vaccine to provide best-in-class efficacy. I look forward to working with the MinervaX team to support the full development of this program.”

ENDS

For further information please contact:

MinervaX

Per Fischer | Chief Executive Officer

Email:

Optimum Strategic Communications

Mary Clark / Stephen Adams/ Zoe Bolt

Email:

Tel: +44 (0) 203 882 9621

Notes to Editors:

About MinervaX

MinervaX is a Danish biotechnology company, established in 2010 to develop a prophylactic vaccine against Group B Streptococcus (GBS), based on research from Lund University. MinervaX is developing a GBS vaccine for maternal immunization, and now also for vaccination of older adults, with Phase II data suggesting superior efficacy compared with other GBS vaccine candidates in development. The latter are based on traditional capsular polysaccharide (CPS) conjugate technology. By contrast, MinervaX’s vaccine is a protein-only vaccine based on fusions of highly immunogenic and protective protein domains from selected surface proteins of GBS (the Alpha-like protein family). Given the broad distribution of proteins contained in the vaccine on GBS strains globally, it is expected that MinervaX’s vaccine will confer protection against virtually 100% of all GBS isolates. www.minervax.com

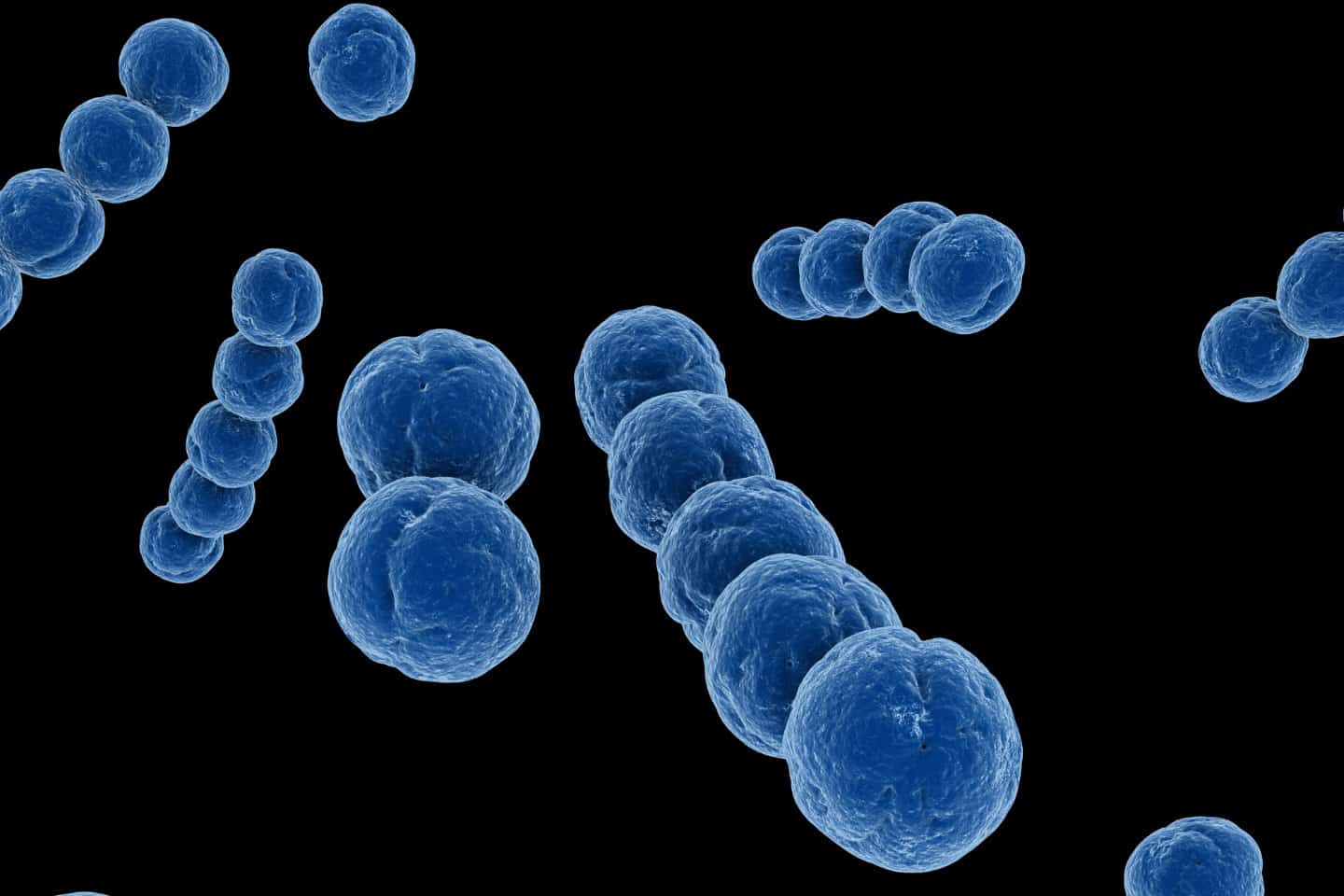

About Group B Streptococcus (GBS)

GBS is responsible for nearly 50% of all life-threatening infections in newborns. At any given time, some 15-25% of women are spontaneously colonized with GBS, and they run the risk of transmitting the bacteria to their child in the womb, during birth and/or during the first months of life. GBS colonization may lead to late abortions, premature delivery, or stillbirth and, in the newborn child, may result in sepsis, pneumonia or meningitis, all of which carry a significant risk of severe morbidity, long- term disability or death.

Currently, the only preventative strategy available involves the use of intravenously delivered prophylactic antibiotics which cannot comprehensively prevent GBS infection in utero and do not protect against late-onset infection in newborns. Not only is this approach expensive and logistically challenging, it fails to cover all, including the most severe cases in the US and Europe, and is rarely available in resource- limited settings. Finally, it carries the risk for increasing antibiotics resistance, a recognized worldwide health threat.

The development of a GBS vaccine is also endorsed by Group B Strep Support and Group B Strep International, and GBS has been prioritized by several public health organizations including the WHO. Both increased uptake of immunization among pregnant women and greater awareness of the implications of GBS suggest that a safe and effective vaccine targeting GBS would be well suited to address this unmet need.

About EQT Life Sciences

EQT Life Sciences was formed in 2022 following an integration of LSP, a leading European life sciences and healthcare venture capital firm, into the EQT platform. As LSP, the firm raised over EUR 3.0 billion (USD 3.5 billion) and supported the growth of more than 150 companies since it started to invest over 30 years ago. With a dedicated team of highly experienced investment professionals, coming from backgrounds in medicine, science, business, and finance, EQT Life Sciences backs the smartest inventors who have ideas that could truly make a difference for patients.

More info: www.eqtgroup.com

Follow EQT on LinkedIn, Twitter, YouTube and Instagram

About OrbiMed

OrbiMed is a healthcare investment firm, with approximately $17 billion in assets under management. OrbiMed invests globally across the healthcare industry through a range of private equity funds, public equity funds, and royalty/credit funds. OrbiMed’s team of over 100 professionals is based in New York City, San Francisco, Shanghai, Hong Kong, Mumbai, Herzliya, London and other key global markets.

More info: www.orbimed.com

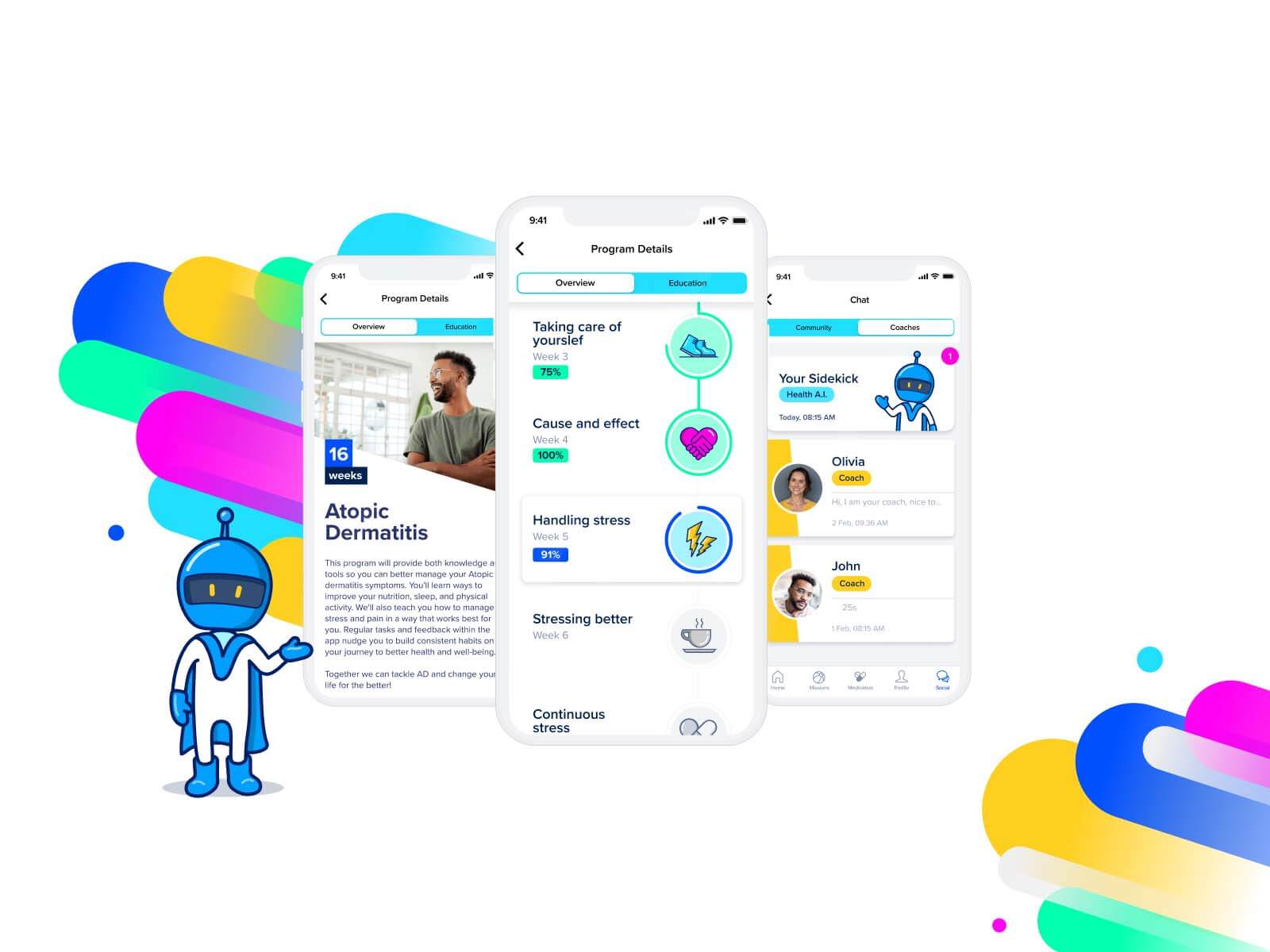

Sidekick Health announces landmark acquisition, expanding its portfolio to offer regulated Prescription Digital Therapeutics

Sidekick Health announces landmark acquisition, expanding its portfolio to offer regulated Prescription Digital Therapeutics

The acquisition of aidhere strengthens Sidekick Health’s digital health offering to patients and partners with the world’s leading PDT company

Las Vegas, October 10, 2023 – Sidekick Health, a global leader in digital health innovation, is poised to transform the landscape of digital therapeutics with the strategic acquisition of aidhere, a leading developer of prescription digital therapeutics (PDT) based in Germany.

In a significant move that underscores Sidekick Health’s commitment to furthering the impact of digital healthcare, the company is thrilled to announce its expansion into the direct prescribing space working collaboratively with healthcare providers.

This acquisition brings with it zanadio, one of the most successful PDTs launched to date. zanadio has fulfilled over 50,000 prescriptions and is recognized within Germany’s regulated nationwide DiGA (Digitale Gesundheitsanwendungen) formulary for prescribable digital apps. Achieving long-term behavioral change and significant weight loss of 8% in patients at the end of 12 months[1], and with over 10,000 doctors prescribing it, zanadio is fully reimbursed for patients with a BMI from 30 to 40 kg/m². As a permanently approved DiGA, zanadio is reimbursed by all statutory health insurers in Germany.

Sidekick Health’s CEO, Dr. Tryggvi Thorgeirsson, shared that the decision to acquire aidhere was fueled by the shared PDT vision and cultural alignment of the two organizations. “Developing and distributing prescribed therapeutics has always been core to our long-term vision, and when we were introduced to aidhere’s remarkable products and exceptional team, we knew that joining forces was the right step to take,” said Thorgeirsson.

This strategic acquisition places Sidekick Health at the forefront of the industry, while presenting exciting opportunities for the introduction of a new offering to Payer partners in the US, and the co-development of prescription digital therapeutic products with global pharmaceutical partners.

By integrating aidhere’s expertise and products into its portfolio, Sidekick Health strengthens its position as a trusted partner for global health insurers and pharmaceutical giants as it pioneers the introduction of PDTs.

In addition to the newly formed PDT business, Sidekick Health’s business is primarily centered on two areas: payers in the US and global pharma. Within the US payer landscape, the company has notably collaborated with the largest US health insurer, and is live with US insurance partners in Medicare, Medicaid and commercial populations. In the pharmaceutical sector, it has cultivated strategic partnerships with industry giants like Pfizer and Eli Lilly, with multiple live programs in both the US and Europe, and expanding to more markets in 2024.

The acquisition brings together the passion, knowledge, and experience of two industry leaders. Sidekick Health’s robust digital health ecosystem, a patient-centric platform with multi-chronic capabilities that supports over 20 disease areas, coupled with aidhere’s expertise in highly-regulated PDTs, creates a synergy poised to redefine patient-centric care. With its platform approach, Sidekick Health is positioned to emerge as a natural consolidator in the digital therapeutics space.

“aidhere has a strong and respected track record within the digital health industry, with one of the most successful PDT products in the world. This acquisition brings market-leading products and a depth of expertise in prescription digital therapeutics to Sidekick, as we enhance and build on our patient care offerings in the digital health and therapeutics space with our global partners,” said Thorgeirsson.

Sidekick Health’s recent success in closing its Series B fundraising round in May 2022 laid the foundations for the company to accelerate innovation and drive even greater impact in the digital health and therapeutics sector. Notable investors in Sidekick Health include Novator Partners, Asabys Partners, Frumtak Ventures, and Wellington Partners.

– ENDS –

About Sidekick Health

Sidekick Health is a digital health and therapeutics innovator founded by two passionate medical doctors on a mission to improve the health of humanity. Sidekick provides a uniquely wide range of digital health programs (including oncology, cardiovascular, metabolic, inflammatory, and other chronic conditions), engaging and empowering people to make positive changes, and improve their health outcomes and quality of life. Sidekick’s Adaptive CarePaths combine multiple programs into one, enabling multi-chronic care to support the growing number of people living with multiple chronic conditions.

Sidekick works with health insurers, including the largest U.S. health insurer, and pharmaceutical companies, including Eli Lilly and Pfizer, to improve patient outcomes, drive clinical efficiency, and lower the cost of care. Sidekick currently operates in multiple global markets and across the U.S., including patients in all insurance classes (Medicare, Medicaid, and Commercial).

Sidekick has offices in Boston, Berlin, Hamburg, Reykjavik, and Stockholm. To learn more, visit www.sidekickhealth.com.

Media Contact:

Serene Touma

Senior Director of Marketing & Communications

+49 1522 6788040

eGenesis Announces Publication in Nature of Landmark Preclinical Data Demonstrating Long-Term Survival with Genetically Engineered Porcine Kidneys

eGenesis Announces Publication in Nature of Landmark Preclinical Data Demonstrating Long-Term Survival with Genetically Engineered Porcine Kidneys

- Proof of concept study resulted in life-supporting organ function and recipient survival of over two years

- Donor kidneys carrying human transgenes resulted in longer survival time

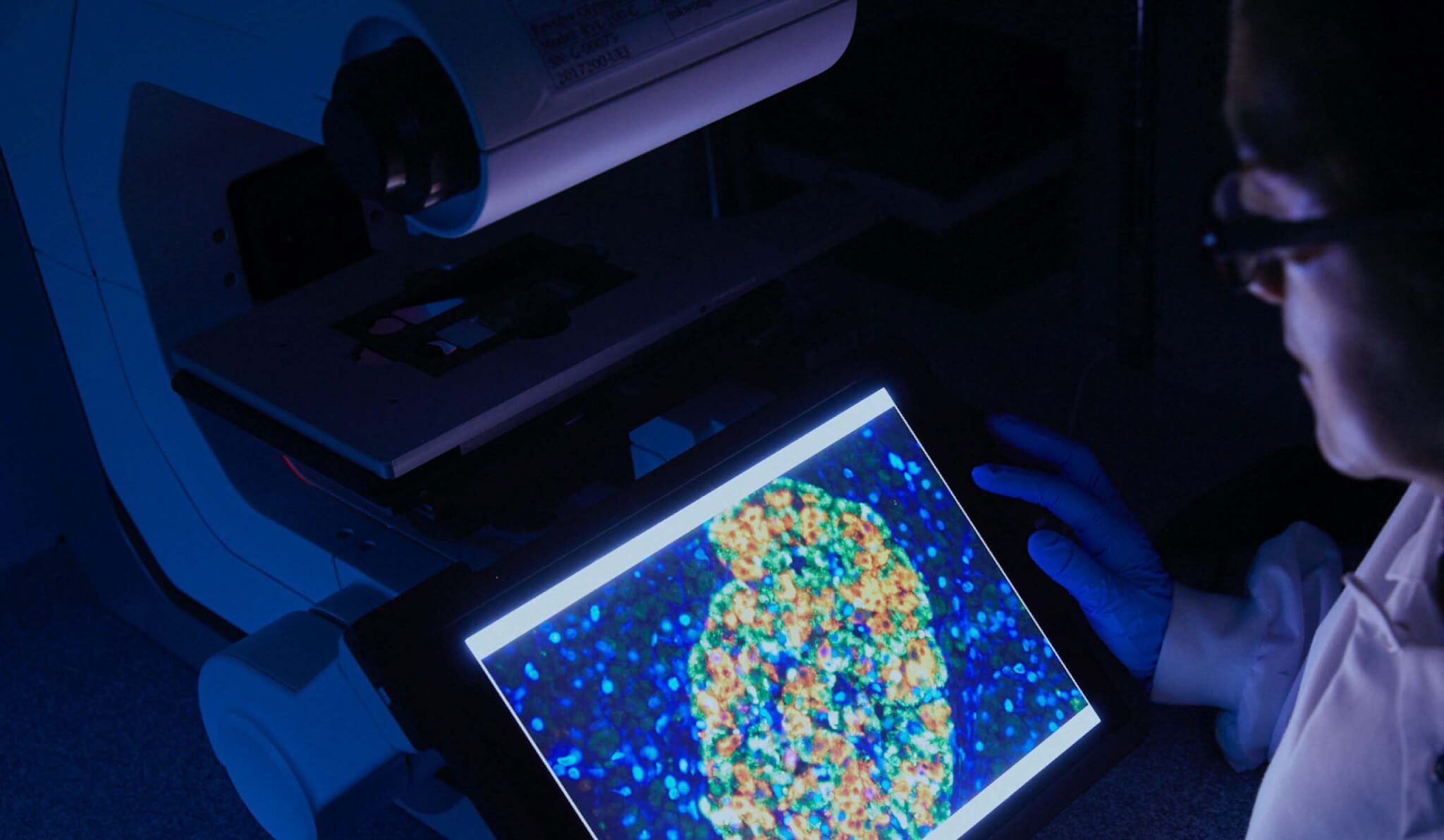

Cambridge, Mass. (Oct 11, 2023) – eGenesis, a biotechnology company developing human-compatible (HuCo™) organs for the treatment of organ failure, today announced publication in the journal Nature of long-term survival data from a proof-of-concept study evaluating engineered porcine donor kidneys transplanted into a cynomolgus macaque model. This dataset will support advancement of the company’s lead candidate for kidney transplant,

EGEN-2784, toward clinical development.

These results represent the largest and most comprehensive preclinical dataset published in the field to date. Recipient survival in the preclinical setting has historically been measured in weeks or months. The publication titled: “Design and Testing of a Humanized Porcine Donor for

Xenotransplantation,” reported long-term survival of NHP recipients of the company’s genetically engineered porcine kidneys. In the case of one recipient, survival of over two years (758 days) was achieved.

“At eGenesis, we are focused on transformational progress for the field – improving long-term survival for transplant recipients from months to years,” said Michael Curtis, Ph.D., Chief Executive Officer of eGenesis. “Our HuCoTM organs offer the hope of a new donor source for the hundreds of thousands of individuals in need of lifesaving organ transplants. The data published in Nature illustrate our rapid advancement in engineering porcine donor organs to enhance recipient compatibility and long-term survival, a critical step toward successful translation in human clinical trials.”

The donor kidneys evaluated in this study carried three types of edits: (1) knock out of three genes involved in the synthesis of glycan antigens implicated in hyperacute rejection, (2) insertion of seven human transgenes involved in the regulation of several pathways that modulate rejection: inflammation, innate immunity, coagulation, and complement, and (3) inactivation of the endogenous retroviruses in the porcine genome.

Donor kidneys carrying human transgenes resulted in longer survival time when transplanted into NHPs. Donor kidneys containing only knock out of the three-glycan antigens experienced poor graft survival, whereas those harboring the knock outs and human transgenes resulted in more than seven times longer duration – a median of 24 days versus 176 days, respectively. The results indicate the benefit of human transgene expression in porcine kidney grafts onlong-term survival.

In vitro functional analysis showed that edited porcine kidney endothelial cells modulated inflammation in a manner that mirrored human endothelial cells, suggesting the edited cells acquired a high level of human immune compatibility. Furthermore, the evaluation of renal function biomarkers in recipients with stable grafts revealed that a single transplanted porcine kidney provided sufficient filtration of metabolites to compensate for the lack of two native kidneys.

“This is a major step forward for the field of transplantation,” said Tatsuo Kawai, M.D., Ph.D., Professor of Surgery at Harvard Medical School and A. Benedict Cosimi Chair in Transplant Surgery at Massachusetts General Hospital. “One of the biggest hurdles has been long-term survival of the genetically engineered organ in the NHP recipient, and this dataset demonstrates remarkable progress in editing the porcine genome to minimize hyperacute rejection, improve recipient compatibility and address the risk of viral transmission from donor to host. We anticipate that transplant outcomes in humans will be even more favorable, as these gene edited organs are a better match for humans, as compared with NHPs.”

The data generated in this study will support the advancement of the company’s lead candidate for kidney transplant, EGEN-2784, toward clinical development. eGenesis is also progressing programs for extracorporeal liver perfusion as well as cardiac transplant.

Organ failure is a life-threatening condition for which transplantation is considered the gold standard treatment. However, the demand for organs far outstrips supply – of the more than 100,000 individuals on the organ transplantation waitlist in the U.S., less than 40% will receive a potentially life-saving organ. In addition, the existing organ failure treatment paradigm is suboptimal for patients and the healthcare system due to organ incompatibility and variable donor organ quality.

About eGenesis

eGenesis is pioneering a genome engineering-based approach in the development of safe and effective transplantable organs. The eGenesis Genome Engineering and Production (EGEN™) Platform is the only technology of its kind to comprehensively address cross-species molecular incompatibilities and viral risk via genetic engineering. eGenesis has demonstrated durable preclinical success to date and is advancing development programs for acute liver failure, kidney transplant, and pediatric as well as adult heart transplant. Learn more at

www.egenesisbio.com.

Media Contact

Kimberly Ha

eGenesis

4SC: Landmark RESMAIN study data presented at the EORTC Cutaneous Lymphoma Tumour Group Annual Meeting

Maintenance therapy is now clinically proven to postpone disease progression in advanced CTCL which could significantly change current clinical practice

- RESMAIN is one of the largest clinical trials in cutaneous T-cell lymphoma (CTCL) to-date

- Resminostat (Kinselby) as a maintenance treatment for advanced CTCL, is clinically proven to postpone disease progression in patients – a new treatment paradigm in CTCL

- Resminostat (Kinselby) treatment has shown a statistically significant improvement in progression free survival of 97.6% compared to placebo, with a risk reduction of 38% in recently announced headline trial results (median PFS: 8.3 months versus 4.2 months; p=0.015; HR: 0.623 (95%CI: 0.424, 0.916)

- Resminostat (Kinselby)’s median time to next treatment (median TTNT) versus placebo showed a significant improvement, more than doubling to 8.8 months compared to 4.2 months; p= 0.002; HR: 594 (95% CI: 0.424, 0.916)

- The side effects of resminostat were mainly mild to moderate, manageable and reversible

- Additional analyses showed

- A clinically meaningful improvement in median “total” PFS (defined from start of last prior therapy to disease progression) of 24.3 months for patients treated with resminostat, compared to 14.9 months for those in the placebo group

- That resminostat (Kinselby) significantly delayed the development of new, or worsening of existing, skin tumours

- 4SC is actively preparing to file for its Marketing Authorization approval in the European Union, Switzerland and UK

- The Company will host a live webinar on Wednesday 4th October to discuss the findings presented at the EORTC. Dr. Susanne Danhauser-Riedl, 4SC’s Chief Medical Officer will be joined by medical experts, Professor Dr. Rudolf Stadler and Professor Julia Scarisbrick.

Planegg-Martinsried, Germany, 25 September 2023 – 4SC AG (4SC, FSE Prime Standard: VSC), a biotech company improving the lives of patients suffering with advanced-stage CTCL, today announces that renowned dermato-oncology expert and study investigator, Professor Dr. Rudolf Stadler, University Hospital Johannes Wesling, Minden, Germany, presented positive new data from the pivotal RESMAN study of resminostat (Kinselby) at the EORTC Cutaneous Lymphoma Tumour Group Annual Meeting, at the Leiden University Medical Center Amsterdam, The Netherlands, 21-23 September.

The presented findings show that maintenance therapy is now clinically proven to postpone disease progression in advanced CTCL which could significantly change clinical practice. In RESMAIN, one of the largest randomized, controlled clinical trials in advanced CTCL, resminostat (Kinselby) treatment has shown a statistically significant improvement in progression free survival of 97.6% compared to placebo, with a risk reduction of 38% in recently announced headline trial results (median PFS: 8.3 months versus 4.2 months; p=0.015; HR: 0.623 (95%CI: 0.424, 0.916).

Furthermore, resminostat (Kinselby)’s median time to next treatment (median TTNT) versus placebo showed a significant improvement of 8.8 months compared to 4.2 months; p= 0.002; HR: 0.594 (95% CI: 0.424, 0.916).

The side effects of resminostat were mainly mild to moderate, manageable and reversible and the known safety profile of resminostat (Kinselby) was confirmed in the RESMAIN study.

Additional analyses established that those treated showed a clinically meaningful improvement in median “total” PFS (defined from start of last prior therapy to disease progression) of 24.3 months, compared to 14.9 months for those in the placebo group. It was also noted that there was a significant delay in the development of new, or worsening of existing, skin tumours.

Jason Loveridge, Ph.D., CEO of 4SC, commented: “Positive data from the RESMAIN study demonstrate that resminostat (Kinselby) is effective in significantly slowing disease progression in CTCL patients. This unique treatment, which is the only proven maintenance therapy for CTCL, means that it is well placed to offer significant benefits for patients who would otherwise have no other similar treatment options available to them.

Our focus in the near term is on the registration, approval and commercialization of Kinselby in the European Union, Switzerland and the UK and we are on track to file for European Marketing Approval of Kinselby in Q1 2024, to rapidly bring this therapy into clinical use. 4SC is well positioned for realization of resminostat (Kinselby)’s considerable value through either a sale, licensing, or partnership agreement.”

The Company will host a live webinar on Wednesday 4th October to discuss the findings presented at EORTC. Dr. Susanne Danhauser-Riedl, 4SC’s Chief Medical Officer, will be joined by medical experts, Professor Dr. Rudolf Stadler and Professor Julia Scarisbrick, who will provide further detail on these data, with the presentation being followed by the opportunity to ask questions during a Q&A session moderated by Dr. Jason Loveridge, 4SC’s Chief Executive Officer.

Title: Presentation by Professor Rudolf Stadler and Professor Julia Scarisbrick on recent new positive data from the RESMAIN study

Date and Time: Wednesday 4th October, 3.00pm CET

Register and submit questions: https://stream.brrmedia.co.uk/broadcast/64f5f2dac6e9d7476c27f154

– END –

About 4SC

4SC AG is a clinical-stage biopharmaceutical company developing small-molecule drugs that target key indications in cancer with high unmet medical needs. 4SC’s pipeline is protected by a comprehensive portfolio of patents and currently comprises one drug candidate in clinical development: Kinselby – resminostat.

4SC aims to generate future growth and enhance its enterprise value by entering into partnerships with pharmaceutical and biotech companies and/or the eventual marketing and sales of approved drugs in select territories by 4SC itself.

4SC is headquartered in Planegg-Martinsried near Munich, Germany. The Company had 16 employees as of 30 June 2023 and is listed on the Prime Standard of the Frankfurt Stock Exchange (FSE Prime Standard: VSC; ISIN: DE000A3E5C40).

About Kinselby (resminostat)

Resminostat is an orally administered class I, IIb and IV histone deacetylase (HDAC) inhibitor that potentially offers an approach to treating different kinds of cancer. Resminostat demonstrated that it is well tolerated and can inhibit tumor growth and proliferation, cause tumor regression, and strengthen the body’s immune response to cancer. Resminostat is currently being investigated in a pivotal study in cutaneous T-cell lymphoma (CTCL) as maintenance treatment by 4SC in Europe and by Yakult Honsha in Japan.

About cutaneous T-cell lymphoma (CTCL)

CTCL is a rare disease with approximately 5,000 patients being newly diagnosed in Europe each year. The disease arises from malignant transformation of T-cells, a specialized subgroup of immune cells, and primarily affects the skin, but may ultimately involve lymph nodes, blood and visceral organs.

Currently, CTCL is incurable and treatment options for advanced-stage CTCL are limited. Although patients respond to the available treatment options, the duration of response is often short-lived and declines as the severity of the disease increases. The key therapeutic challenge in advanced-stage CTCL is therefore to make remissions more durable by halting disease progression and improving patient’s quality of life.

About the RESMAIN study – resminostat for maintenance treatment of CTCL

The pivotal RESMAIN study was conducted at more than 50 clinical centers in 11 European countries and Japan. It included 201 patients who suffer from advanced-stage cutaneous T-cell lymphoma (CTCL) that have achieved disease control with systemic therapy. The patients were randomized 1:1 to receive either resminostat or placebo. Patients who experienced disease progression – while being on placebo – were offered resminostat in an open label treatment arm.

The primary goal of the study was to determine whether maintenance treatment with resminostat prolongs progression-free survival and other secondary objectives. Data demonstrating that resminostat met the primary endpoint of the RESMAIN study was published in May 2023.

About the concept of maintenance therapy

The pivotal RESMAIN study is focused on patients with advanced-stage, incurable, cutaneous T-cell lymphoma (CTCL). Such patients suffer from painful and itchy skin lesions resulting in disfigurement and a severely impaired quality of life. Furthermore, lymph nodes, blood or visceral organs can be involved. The current therapeutic options rarely provide long-lasting responses or stabilization of disease for meaningful periods, with most patients progressing within a few months.

Resminostat is being evaluated as maintenance treatment – a unique innovative treatment approach in CTCL (Stadler et al., 2021) - intended to prolong the period patients are stable and not progressing.

Forward-looking information

Information set forth in this press release contains forward-looking statements, which involve risks and uncertainties. The forward-looking statements contained herein represent the judgement of 4SC as of the date of this press release. Such forward-looking statements are neither promises nor guarantees, but are subject to a variety of risks and uncertainties, many of which are beyond 4SC’s control, and which could cause actual results to differ materially from those contemplated in these forward-looking statements. 4SC expressly disclaims any obligation or undertaking to release any updates or revisions to any such statements to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based.

Contacts:

| 4SC AG | |

| Optimum Strategic Communications | |

| Mary Clark, Jonathan Edwards, Eleanor Cooper | |

Moderna and Immatics Announce Strategic Multi-Platform Collaboration to Develop Innovative Oncology Therapeutics

Moderna and Immatics Announce Strategic Multi-Platform Collaboration to Develop Innovative Oncology Therapeutics

- Collaboration combines leading technologies to develop breakthrough, mRNA-enabled in vivo expressed TCER® molecules

- Companies to leverage Immatics’ XPRESIDENT® target discovery platform and Moderna’s mRNA technology for the development of novel cancer vaccines

- Collaboration to include evaluation of Immatics’ investigational IMA203 PRAME TCR-T in combination with Moderna’s investigational PRAME mRNA cancer vaccine

- Immatics to receive $120 million upfront cash payment plus research funding with the potential for additional milestone and royalty payments

Cambridge, Massachusetts and Tuebingen, Germany, September 11, 2023 – Moderna, Inc. (NASDAQ: MRNA, “Moderna”) and Immatics N.V. (NASDAQ: IMTX, “Immatics”), a clinical-stage biopharmaceutical company active in the discovery and development of T cell-redirecting cancer immunotherapies, today announced a strategic research and development collaboration to pioneer novel and transformative therapies for cancer patients with high unmet medical need. This broad multi-platform collaboration will leverage the deep scientific expertise and core operational capabilities of both companies, combining Immatics’ TCR platform with Moderna’s cutting-edge mRNA technology, and span various therapeutic modalities including bispecifics, cell therapy and cancer vaccines.

The strategic R&D collaboration between Moderna and Immatics focuses on three pillars:

- Applying Moderna’s mRNA technology for in vivo expression of Immatics’ next-generation, half-life extended TCR bispecifics (TCER®) targeting cancer-specific HLA-presented peptides.

- Enabling the discovery and development of novel mRNA-based cancer vaccines by leveraging Moderna’s deep knowledge of mRNA science and customized information from Immatics’ wealth of tumor and normal tissue data included in the target discovery platform XPRESIDENT® and its bioinformatics and AI platform XCUBE™.

- Evaluating Immatics’ IMA203 TCR-T therapy targeting PRAME in combination with Moderna’s PRAME mRNA-based cancer vaccine. The collaboration contemplates conducting preclinical studies and a Phase 1 clinical trial evaluating the safety and efficacy of the combination with the objective of further enhancing IMA203 T cell responses.

“We are excited to embark on this strategic collaboration with Immatics, a pioneer in developing innovative cancer immunotherapies. This partnership presents a groundbreaking opportunity to leverage our mRNA technology alongside Immatics’ TCR platform, potentially diversifying and augmenting the way we approach cancer treatment. We believe this collaboration will accelerate the development of novel oncology therapies and bring us one step closer to providing significant benefits for patients with high unmet medical needs,” said Rose Loughlin, Ph.D., Moderna’s Senior Vice President for Research and Early Development.

“We are thrilled to join forces with Moderna in our quest to pioneer innovative and transformative therapies to combat cancer. We believe Immatics’ cancer target and TCR platforms, along with Moderna’s cutting-edge mRNA technology, represent a powerful combination that has the potential to deliver meaningful benefits to cancer patients,” said Toni Weinschenk, PhD, Chief Innovation Officer at Immatics. “The rapid advancement of our first 2 TCER® programs into the clinic, with additional TCER® compounds fueling our pre-clinical pipeline, underscores our commitment to develop innovative therapeutics. We are confident that we can explore the optimal delivery of TCER® molecules through this collaboration to maximize clinical benefit in a broad patient population,” added Carsten Reinhardt, MD, PhD, Chief Development Officer of Immatics.

About the Collaboration

Under the terms of the agreement, Immatics will receive an upfront payment of $120 million. Immatics will also receive research funding and is eligible to receive development, regulatory, and commercial milestone payments that could exceed $1.7 billion. Immatics is also eligible to receive tiered royalties on global net sales of TCER® products and certain vaccine products that are commercialized under the agreement. Under the agreement, Immatics has an option to enter into a global profit and loss share arrangement for the most advanced TCER®.

Moderna will lead the clinical development and commercialization of cancer vaccines and TCER® therapeutics resulting from the collaboration. Immatics will be responsible for conducting the preclinical studies and a potential Phase 1 clinical trial investigating IMA203 TCR-T in combination with the PRAME mRNA vaccine to further enhance IMA203 T cell responses. Each party will retain full ownership of its investigational PRAME compound, and the parties will fund the clinical study on a cost sharing basis.

Within the collaboration, preclinical activities conducted by Immatics will be managed by the Immatics Discovery Unit, a recently created internal division at Immatics integrating its technology platforms into one interdisciplinary team focused on all early-stage preclinical pipeline and collaboration programs.

The collaboration is subject to customary antitrust clearance in the United States.

– END –

About Moderna

In over 10 years since its inception, Moderna has transformed from a research-stage company advancing programs in the field of messenger RNA (mRNA), to an enterprise with a diverse clinical portfolio of vaccines and therapeutics across seven modalities, a broad intellectual property portfolio in areas including mRNA and lipid nanoparticle formulation, and an integrated manufacturing plant that allows for both clinical and commercial production at scale. Moderna maintains alliances with a broad range of domestic and overseas government and commercial collaborators, which has allowed for the pursuit of both groundbreaking science and rapid scaling of manufacturing. Most recently, Moderna’s capabilities have come together to allow the authorized use and approval of one of the earliest and most effective vaccines against the COVID-19 pandemic.

Moderna’s mRNA platform builds on continuous advances in basic and applied mRNA science, delivery technology, and manufacturing, and has allowed the development of therapeutics and vaccines for infectious diseases, immune-oncology, rare diseases, cardiovascular diseases, and autoimmune diseases. Moderna Genomics was created to leverage the recent advancement in both the RNA delivery platform and the genomic medicines to create the next generation of in vivo gene editing therapeutics. Moderna has been named a top biopharmaceutical employer by Science for the past eight years. To learn more, visit www.modernatx.com.

Moderna Forward-Looking Statements:

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended, including regarding: the agreement between Moderna and Immatics to develop innovative oncology therapeutics; the opportunity presented by the collaboration to leverage Moderna’s mRNA technology alongside Immatics’ TCR platform to potentially diversify and augment the way we approach cancer treatment; the potential for the collaboration to accelerate the development of novel oncology therapies; and the antitrust clearance process in the United States. The forward-looking statements in this press release are neither promises nor guarantees, and you should not place undue reliance on these forward-looking statements because they involve known and unknown risks, uncertainties, and other factors, many of which are beyond Moderna’s control and which could cause actual results to differ materially from those expressed or implied by these forward-looking statements. These risks, uncertainties, and other factors include those other risks and uncertainties described under the heading “Risk Factors” in Moderna’s Annual Report on Form 10-K for the year ended December 31, 2022, filed with the U.S. Securities and Exchange Commission (SEC), and in subsequent filings made by Moderna with the SEC, which are available on the SEC’s website at www.sec.gov. Except as required by law, Moderna disclaims any intention or responsibility for updating or revising any forward-looking statements contained in this press release in the event of new information, future developments or otherwise. These forward-looking statements are based on Moderna’s current expectations and speak only as of the date of this press release.

About Immatics

Immatics combines the discovery of true targets for cancer immunotherapies with the development of the right T cell receptors with the goal of enabling a robust and specific T cell response against these targets. This deep know-how is the foundation for our pipeline of Adoptive Cell Therapies and TCR Bispecifics as well as our partnerships with global leaders in the pharmaceutical industry. We are committed to delivering the power of T cells and to unlocking new avenues for patients in their fight against cancer.

Immatics intends to use its website www.immatics.com as a means of disclosing material non-public information. For regular updates you can also follow us on Twitter, Instagram and LinkedIn.

Immatics Forward-Looking Statements:

Certain statements in this press release may be considered forward-looking statements. Forward-looking statements generally relate to future events or Immatics’ future financial or operating performance. For example, statements concerning the timing of product candidates and Immatics’ focus on partnerships to advance its strategy are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expect”, “intend”, “will”, “estimate”, “anticipate”, “believe”, “predict”, “potential” or “continue”, or the negatives of these terms or variations of them or similar terminology. Such forward-looking statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed or implied by such forward looking statements. These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by Immatics and its management, are inherently uncertain. New risks and uncertainties may emerge from time to time, and it is not possible to predict all risks and uncertainties. Factors that may cause actual results to differ materially from current expectations include, but are not limited to, various factors beyond management’s control including general economic conditions and other risks, uncertainties and factors set forth in filings with the SEC. Nothing in this press release should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. Immatics undertakes no duty to update these forward-looking statements.

Moderna Contacts:

| Media Contact | |

| Chris Ridley | |

| Vice President, Communications | |

| Phone: +1 617-800-3651 | |

| Investor Relations Contact | |

| Lavina Talukdar | |

| Senior Vice President & Head of Investor Relation | |

| Phone: +1 617-209-5834 | |

Immatics Contacts:

| Media and Investor Relations Contact | |

| Eva Mulder or Charlotte Spitz | |

| Trophic Communications | |

| Phone: +31 6 52 33 15 79 | |

| Immatics N.V. | |

| Anja Heuer | Sabrina Schecher, Ph.D. |

| Senior Director, Corporate Communications | Senior Director, Investor Relations |

| Phone: +49 89 540415-606 | Phone: +49 89 262002433 |

Confo Therapeutics Appoints Dieter Weinand, Former CEO of Bayer Pharmaceuticals, as Independent Chairman

Confo Therapeutics Appoints Dieter Weinand, Former CEO of Bayer Pharmaceuticals, as Independent Chairman

Ghent, Belgium – August 29, 2023 – Confo Therapeutics, a leader in the discovery of medicines targeting G-protein coupled receptors (GPCRs), today announced the appointment of Dieter Weinand as Independent Chairman of its Board of Directors. Mr. Weinand brings with him a wealth of experience with more than 35 years in the pharmaceutical industry and over 25 years as the leader of geographic and strategic business units and drug commercialization efforts across global organizations, including several years as the President, CEO and Chairman of the Board of Bayer Pharmaceuticals AG. He joins Confo as the company advances its pipeline and continues to leverage its proprietary GPCR drug discovery engine. Mr. Weinand succeeds John Berriman, who is retiring from his current position as Chairman of Confo’s Board of Directors.

“Dieter is an exceptional leader in the pharmaceutical industry with a proven track record across the spectrum of research and development to commercialization, bringing impactful medications to patients. A chairman of his caliber will be invaluable as we continue progressing as an organization with a truly innovative GPCR-targeting technology and a growing pipeline of novel drug candidates,” said Cedric Ververken, CEO of Confo Therapeutics. “On behalf of the Confo team, I sincerely thank John Berriman for his guidance over the past seven years and his contributions to Confo’s growth into a clinical-stage drug development company.”

“Confo is moving on an exciting trajectory, harnessing the momentum of a pivotal agreement with Eli Lilly for its first clinical program, CFTX-1554, and building out a robust pipeline of large and small molecules based on its unique platform,” added Dieter Weinand, Independent Chairman. “I look forward to working together with the Confo team to advance the company through its next stages of growth and to achieve its future strategic business and pipeline objectives.”

Mr. Weinand has had a highly successful career across all areas of pharmaceutical development, commercialization, and international organizational leadership. Most recently, he was Head of Global Primary Care Business at Sanofi where he led the optimization of the company’s portfolios. Before this, he was President, CEO, and Chairman of the Board of Bayer Pharmaceuticals AG, where he was responsible for integrating the R&D, manufacturing, and all commercial and support functions of the healthcare business of the Bayer AG corporation. Mr. Weinand held various senior management positions across international corporations including at Bristol-Meyers Squibb and Pfizer. He has been instrumental in the launch and marketing of some of the industry’s pivotal products including Lipitor®, Neurontin®, Abilify® and Cipro®. Mr. Weinand holds a B.A. in Biology from Concordia College, New York, and an M.S. in Pharmacology and Toxicology from Long Island University, New York. Mr. Weinand is Chairman of the Board of Nasdaq-listed Replimune (REPL), FORE Biotherapeutics, and ZielBio, among others.

About Confo Therapeutics

Confo Therapeutics is the only GPCR company with a proprietary discovery engine that precisely targets desired GPCR conformations. This unique capability allows us to unlock a vast untapped potential for the discovery and development of breakthrough medicines. We are advancing a robust pipeline of large and small molecules focused on validated targets in endocrine and metabolic diseases, as well as addressing a broader array of critical unmet medical needs in collaboration with our partners. Our team of accomplished experts is dedicated to advancing our patent protected technology, expanding our capabilities, and building out our pipeline in order to achieve the best possible therapeutic outcomes for patients. For more information, visit www.confotherapeutics.com

For more information, please contact:

Confo Therapeutics

Dr. Cedric Ververken, CEO

+ 32 (0) 9 396 74 00

Email:

Trophic Communications

Valeria Fisher or Desmond James

+49 175 8041816 or +49 (0) 1516 7859086

Email:

Quanta™ Announces Enrollment Completion in Home Run Study

Quanta™ Announces Enrollment Completion in Home Run Study

Multi-center trial assesses efficacy and safety of the Quanta Dialysis System

BEVERLY, Massachusetts – August 17, 2023 – Quanta Dialysis Technologies® today announced that it has completed enrollment of its Home Run study for at-home hemodialysis. The Home Run study is a prospective, multi-center, open-label trial to assess the efficacy and safety of the Quanta Dialysis System for home hemodialysis. Results are expected to be announced in the second half of 2023.

“People with end-stage kidney disease on hemodialysis are currently limited as to options available. Although frequent home hemodialysis is proven to deliver superior outcomes, for many, in-center dialysis treatment three times a week is the only viable option,” said Quanta Chief Medical Officer, Dr. Paul Komenda, MHA, FRCPC, FASN. “We hope that FDA clearance of an additional home hemodialysis device will contribute to more patients having access to regular care in their home environment. Enrollment completion is the first step forward in a potential new alternative for people with this life-threatening disease.”

About the Home Run Study

The Home Run study is establishing non-inferiority in safety and efficacy when the Quanta Dialysis System is used in the self-care home environment with a care partner compared to a hemodialysis facility. Following enrollment, study participants begin hemodialysis treatments using the system on a prescription of four-hour treatments, three times per week for a minimum of four weeks. During this time, both patients and their caregivers will undergo extensive training and competency sign off on all aspects of safely administering hemodialysis treatment in the home. Upon completion of training and a one-week transition period, participants will perform home treatment four times per week for three-and-one-half hours per treatment for eight weeks.

About End-Stage Kidney Disease (ESKD)

End-stage kidney disease is the final stage of chronic kidney disease, where kidney function has declined enough to the point where the kidneys can longer function on their own. With fully functioning kidneys, waste and excess fluids from the blood are filtered and then excreted in urine. For those with ESKD, the kidneys lose their filtering abilities and dangerous levels of fluid, electrolytes and waste build up in the body. Approximately 800,000 people in the United States are living with ESKD, 71% of which rely on dialysis to manage the disease, while the remaining 29% have a functioning kidney transplant.

About the Quanta Dialysis System

The Quanta Dialysis System is a compact, easy-to-use hemodialysis device FDA-cleared for use in patients with acute and/or chronic renal failure, with or without ultrafiltration, in an acute or chronic care facility. It is also CE-mark approved for use in center or at-home in the UK by adult patients with AV fistula or graft or central venous catheter, and who have an estimated dry weight of greater than 40kg.

About Quanta Dialysis Technologies

Quanta Dialysis Technologies is committed to making dialysis accessible to every patient in every setting with its Quanta Dialysis System. As a portable device with performance comparable to larger, traditional machines, the Quanta Dialysis System is a modular and powerful solution that provides the clinical versatility needed to deliver dialysis care across multiple settings. With a simple-to-use and intuitive user interface, it is designed to be operated by a broad range of users to bring dialysis directly to patients.

The Quanta Dialysis System is commercially available in the United Kingdom for home and

hospital use and in the United States, it is FDA-cleared (K222067) for use in chronic and acute care settings. It is not cleared for home or nocturnal use in the United States.

To learn more about Quanta and its products, visit quantadt.com.

###

Media Contact:

Melinda Freson

Immatics Initiates Phase 1/2 Clinical Trial to Evaluate PRAME TCR Bispecific IMA402 in Patients with Advanced Solid Tumors

Immatics Initiates Phase 1/2 Clinical Trial to Evaluate PRAME TCR Bispecific IMA402 in Patients with Advanced Solid Tumors

TCER® IMA402 is the first next-generation, half-life extended TCR Bispecific targeting PRAME to enter the clinic Patient enrollment for IMA402 Phase 1/2 trial underway The trial will evaluate safety, tolerability, and anti-tumor activity of IMA402 in patients with recurrent and/or refractory solid tumors First clinical data expected in 2024

Tuebingen, Germany and Houston, Texas, August 10, 2023 – Immatics N.V. (NASDAQ: IMTX, “Immatics”), a clinical-stage biopharmaceutical company active in the discovery and development of T cell-redirecting cancer immunotherapies, today announced the initiation of a Phase 1/2 clinical trial with its proprietary Bispecific T cell engaging receptor (TCER®) IMA402. IMA402 is the second product candidate in Immatics’ TCER® pipeline of next-generation, half-life extended bispecific molecules to enter clinical development. It targets an HLA-A*02:01-presented peptide derived from PRAME, a clinically established cancer target frequently expressed in a large variety of solid tumors.

The Phase 1/2 clinical trial (NCT05958121) investigates TCER® IMA402 in HLA-A*02:01-positive patients with PRAME-expressing recurrent and/or refractory solid tumors. The dose escalation part of the study is designed as a basket trial in focus indications to accelerate signal finding. Initial focus indications are cutaneous and uveal melanoma, ovarian cancer, lung cancer, uterine cancer and synovial sarcoma, among others.

“The addition of IMA402 to our clinical pipeline is a truly exciting step and aligns with our strategic goal to harness the full potential of PRAME, one of the most promising cancer targets in solid tumors. With our half-life extended format, we believe IMA402 has the potential to be an attractive treatment option by enhancing efficacy, minimizing toxicities, and providing favorable dosing regimen for cancer patients.,” said Cedrik Britten, Chief Medical Officer at Immatics. “We are working with urgency to bring IMA402 to a broad patient population as quickly as possible and look forward to sharing first clinical data in 2024.”

Primary objectives of the IMA402 Phase 1/2 trial are to determine the maximum tolerated dose (MTD) and/or the recommended doses for trial extensions, as well as to characterize safety and tolerability of IMA402. Secondary objectives are to evaluate anti-tumor activity and assess pharmacokinetics of IMA402. The Phase 1a dose escalation will be followed by a Phase 1b dose expansion, with the plan then to initiate a Phase 2 with indication-specific cohorts and/or combination therapies. Immatics has implemented an adaptive design for the dose escalation with the goal of accelerating the clinical development timeline of IMA402. Pharmacokinetics data will be assessed throughout the trial and might provide an early opportunity for adjustment of the treatment interval based on the half-life extended TCER® format. The trial is initially planned to be conducted at approximately 15 sites in Europe, with extension into the US at dose expansion stage. The Phase 1a is designed to enroll approximately 45 patients.

The trial initiation is based on the comprehensive preclinical studies with IMA402 presented at the European Society for Medical Oncology (ESMO) Congress 2022.

TCER® IMA402 is the second Immatics clinical program targeting PRAME, with the first being ACTengine® IMA203, a TCR-T cell therapy which is currently being evaluated in a Phase 1b dose expansion. Both approaches, ACTengine® and TCER®, are distinct therapeutic modalities that Immatics believes to have the potential to provide innovative treatment options for a variety of cancer patient populations with different medical needs.

About IMA402

TCER® IMA402 is a drug candidate owned by Immatics. IMA402 is Immatics’ second TCER® molecule from the bispecifics pipeline and is directed against an HLA-A*02-presented peptide derived from preferentially expressed antigen in melanoma (PRAME), a protein frequently expressed in a large variety of solid cancers, thereby supporting the program’s potential to address a broad cancer patient population. Immatics’ PRAME peptide is present at a high copy number per tumor cell and is homogenously and specifically expressed in tumor tissue. The peptide has been identified and characterized by Immatics’ proprietary mass spectrometry-based target discovery platform, XPRESIDENT®. IMA402 is part of Immatics’ strategy to leverage the full clinical potential of targeting PRAME, one of the most promising targets for TCR-based therapies.

About TCER®

Immatics’ next-generation half-life extended TCER® molecules are antibody-like “off-the-shelf” biologics that leverage the body’s immune system by redirecting and activating T cells towards cancer cells expressing a specific tumor target. The design of the TCER® molecules enables the activation of any T cell in the body to attack the tumor, regardless of the T cells’ intrinsic specificity. Immatics proprietary biologics are engineered with two binding regions: a TCR domain and a T cell recruiter domain. The TCER® format is designed to maximize efficacy while minimizing toxicities in patients. It contains a high-affinity TCR domain that is designed to bind specifically to the cancer target peptide on the cell surface presented by an HLA molecule. The antibody-derived, low-affinity T cell recruiter domain is directed against the TCR/CD3 complex and recruits a patient’s T cells to the tumor to attack the cancer cells. With a low-affinity recruiter aiming for optimized biodistribution and enrichment of the molecule at the tumor site instead of the periphery, TCER® are engineered to reduce the occurrence of immune-related adverse events, such as cytokine release syndrome. In addition, the TCER® format consists of an Fc-part conferring half-life extension, stability, and manufacturability. TCER® are “off-the-shelf” biologics and thus immediately available for patient treatment. They can be distributed through standard pharmaceutical supply chains and provide the opportunity to reach a large patient population without the need for specialized medical centers.

– END –

About Immatics

Immatics combines the discovery of true targets for cancer immunotherapies with the development of the right T cell receptors with the goal of enabling a robust and specific T cell response against these targets. This deep know-how is the foundation for our pipeline of Adoptive Cell Therapies and TCR Bispecifics as well as our partnerships with global leaders in the pharmaceutical industry. We are committed to delivering the power of T cells and to unlocking new avenues for patients in their fight against cancer.

Immatics intends to use its website www.immatics.com as a means of disclosing material non-public information. For regular updates you can also follow us on Twitter, Instagram and LinkedIn.

Forward-Looking Statements:

Certain statements in this press release may be considered forward-looking statements. Forward-looking statements generally relate to future events or Immatics’ future financial or operating performance. For example, statements concerning the timing of product candidates and Immatics’ focus on partnerships to advance its strategy are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expect”, “intend”, “will”, “estimate”, “anticipate”, “believe”, “predict”, “potential” or “continue”, or the negatives of these terms or variations of them or similar terminology. Such forward-looking statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed or implied by such forward looking statements. These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by Immatics and its management, are inherently uncertain. New risks and uncertainties may emerge from time to time, and it is not possible to predict all risks and uncertainties. Factors that may cause actual results to differ materially from current expectations include, but are not limited to, various factors beyond management’s control including general economic conditions and other risks, uncertainties and factors set forth in filings with the SEC. Nothing in this press release should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. Immatics undertakes no duty to update these forward-looking statements. All the scientific and clinical data presented within this press release are – by definition prior to completion of the clinical trial and a clinical study report – preliminary in nature and subject to further quality checks including customary source data verification.

For more information, please contact:

| Media and Investor Relations Contact | |

| Eva Mulder or Charlotte Spitz | |

| Trophic Communications | |

| Phone: +31 6 52 33 15 79 | |

| Immatics N.V. | |

| Anja Heuer | Jordan Silverstein |

| Senior Director, Corporate Communications | Head of Strategy |

| Phone: +49 89 540415-606 | Phone: +1 281 810 7545 |

Quanta™ Receives FDA 510(k) Clearance for Expanded Indication of Continuous Renal Replacement Therapies

Quanta™ Receives FDA 510(k) Clearance for Expanded Indication of Continuous Renal Replacement Therapies

Quanta Dialysis System becomes first-in-class to perform three standard-of-care dialysis modalities in one device

BEVERLY, Mass., Aug. 3, 2023 /PRNewswire/ — Quanta Dialysis Technologies®, a medical technology company committed to making kidney care more accessible, today announced that it received U.S. Food and Drug Administration (FDA) 510(k) clearance for an expanded indication of the Quanta Dialysis System, a compact and easy-to-use hemodialysis device, for two modalities of continuous renal replacement therapy (CRRT): continuous venovenous hemodialysis (CVVHD) and slow continuous ultrafiltration (SCUF). Under the new 510(k), the Quanta Dialysis System is the only dialysis device FDA-cleared to provide intermittent hemodialysis (IHD), sustained low efficiency dialysis (SLED) or bagless CRRT which creates dialysate on demand – all in a single machine.

The Quanta Dialysis System was originally designed to serve the more than two million people with end-stage kidney disease (ESKD) worldwide who receive treatment with dialysis or a kidney transplant. The latest addition of its Trinal Kidney Therapy™ (TKT) software provides a treatment solution for critically ill patients diagnosed with acute kidney injury (AKI) who require dialysis. It features dialysate flow rates from 50 to 500 mL/min and treatment times up to 24 hours of continuous delivery.

“This clearance is a true game-changer for acute care settings,” said Quanta Chief Executive Officer, Alejandro Galindo. “Hospitals are often constrained with limited space and nursing staff. The Quanta Dialysis System with TKT software provides an all-in-one solution for hospitals with an intensive care unit (ICU) looking to reduce their device footprint, maximize their operational efficiencies, reduce burden on nurses and substantially lower consumables expenses.”

Mortality for ICU patients with severe AKI who need dialysis has been reported to exceed 50% in patients often requiring intravenous life support to maintain a minimum blood pressure. CRRT offers a slower and gentler alternative to conventional dialysis; continuous dialysis runs 24 hours a day as compared to traditional hemodialysis which occurs over a four-hour period enabling better real time management of volume and biochemistry for patients.

“Critically ill patients that are hemodynamically unstable, such as those with severe AKI, are more challenging to manage in the ICU balancing volume status, inotropic support and ventilation requirements. Because of its slower rate of fluid removal, CRRT may cause less stress for the patient and enable more real-time decision making for clinical teams on a minute-to-minute basis,” said Quanta Chief Medical Officer, Dr. Paul Komenda, MHA, FRCPC, FASN. “However, once the hemodynamic status of the patient has improved, a transition to IHD or SLED may be the best option. A device than can perform all three modalities in one is ideal.”

Quanta is ready to commercialize the Quanta Dialysis System with TKT software and expects to officially launch the product at the 2023 American Society of Nephrology Annual Meeting.

About Quanta Dialysis Technologies

Quanta Dialysis Technologies is committed to making dialysis accessible to every patient in every setting with its Quanta Dialysis System. As a portable device with performance comparable to larger, traditional machines, the Quanta Dialysis System is a modular and powerful solution that provides the clinical versatility needed to deliver dialysis care across multiple settings. With a simple-to-use and intuitive user interface, it is designed to be operated by a broad range of users to bring dialysis directly to patients.

The Quanta Dialysis System is commercially available in the United Kingdom for home and hospital use and in the United States, it is FDA-cleared (K222067) for use in chronic and acute care settings. It is not cleared for home or nocturnal use in the United States.

To learn more about Quanta and its products, visit quantadt.com.